With rising expenses, subscriptions, and digital payments, people need smarter ways to stay in control.

That’s where budgeting apps & personal finance apps have become important. UPI payments, cards, online shopping, & recurring bills make it hard to remember where money actually goes.

This is why expense trackers and money management apps are now part of daily life.

They automatically record spending, categorize expenses, and give a clear picture of your financial habits, something manual methods simply can’t match.

Why Manual Budgeting Fails for Most Users?

- Writing expenses in notebooks or spreadsheets sounds good, but most people stop updating them after a few days.

- Manual budgeting takes time, lacks accuracy, and gives no real insights.

- Users abandon manual budgeting because it feels confusing, slow, and inconsistent. This is exactly why people search for budget tracker apps.

How Modern Budget Planner Apps Simplify Money Management?

- Modern budget planner apps do much more than track spending. They analyze patterns, send alerts when you overspend, and help set realistic savings goals.

- The best personal finance apps turn complex money data into easy-to-understand insights.

- With smart automation, budgeting apps help users save money, plan better, and feel confident about their finances.

Here you will learn about the top personal finance apps that you should start using.

What Makes a Budgeting App Truly Effective for Expense Tracking?

We evaluate the best budgeting apps based on real user needs. A truly effective expense tracker or budget tracker must solve real problems simply & securely.

1. Real-Time Expense Tracking Accuracy

- The best budgeting apps offer real-time expense tracking.

- This means expenses are updated instantly, helping users see exactly how much they’ve spent and what’s left.

- Accurate tracking builds trust and helps users make smarter daily decisions.

2. Smart Budget Planner Features

- A powerful budget planner should automatically categorize expenses, create monthly budgets, and show spending trends.

- Smart insights like “where you overspend” or “how to save more” are what separate average apps from the best budgeting apps on the market.

3. Ease of Use for Beginners

- Many users searching for a budget tracker app for beginners want simplicity.

- Clean design, easy setup, and clear dashboards matter more than complex charts.

4. Data Security & Privacy

- Since personal finance apps handle sensitive financial data, security is important.

- The best expense tracker apps use encryption, secure logins, and privacy-first policies.

- We believe trust is a key factor in long-term app adoption.

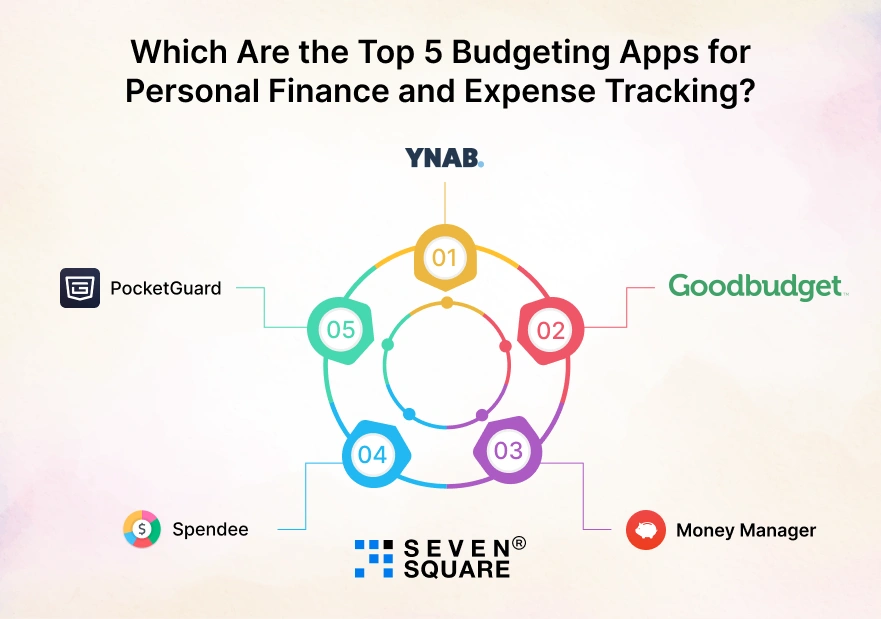

Which Are the Top 5 Budgeting Apps for Personal Finance and Expense Tracking?

We closely analyze how people actually use budgeting apps in real life.

Based on usability, features, and search demand, here are the top 5 budgeting apps for personal finance and expense tracking that users trust the most.

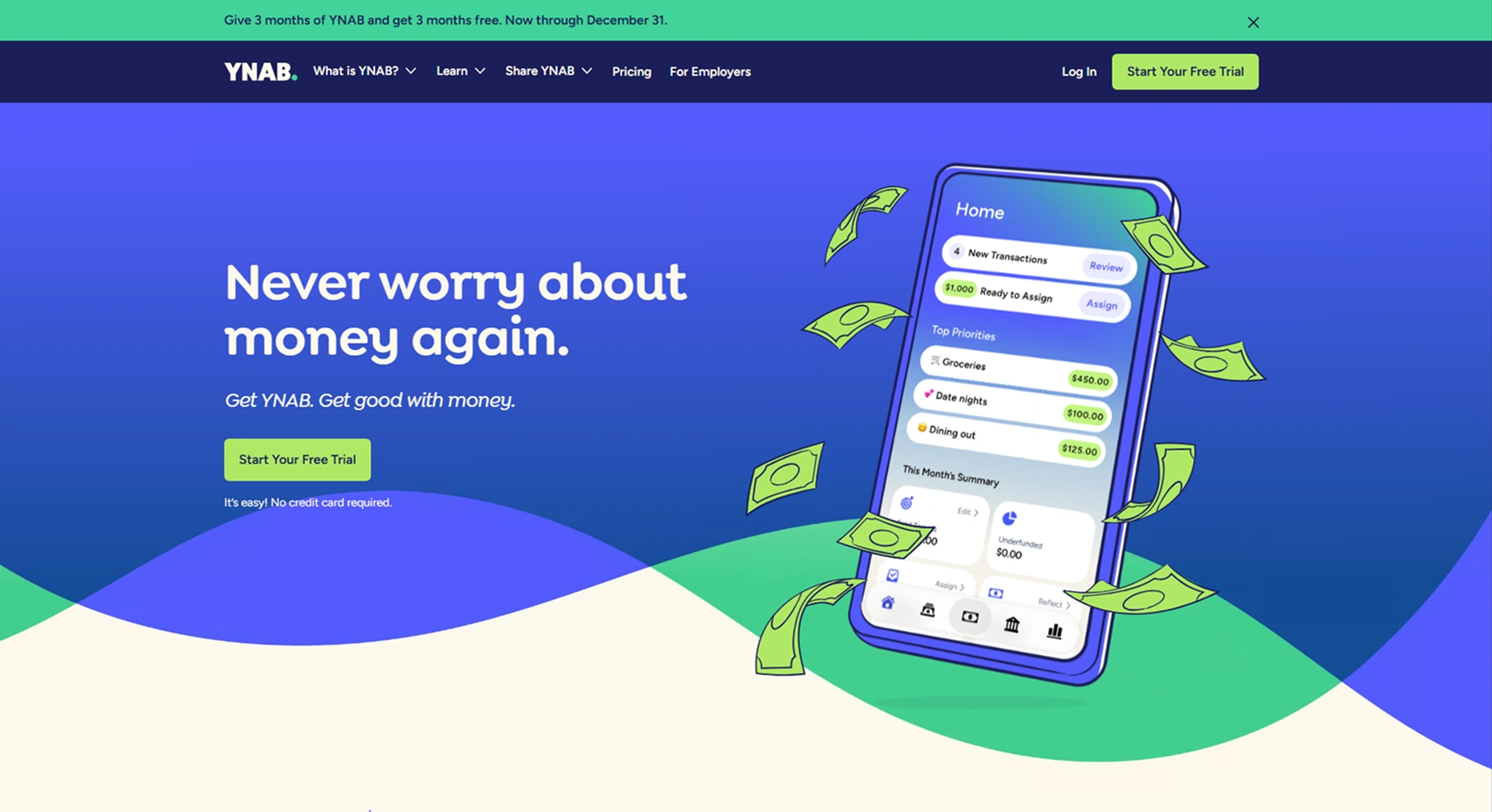

1. YNAB (You Need A Budget): Best Budgeting App to Track Spending Daily

YNAB is one of the most powerful expense tracker apps for people who want full control over their money.

It focuses on giving every rupee or dollar a purpose.

Key Features

- Real-time expense tracking.

- Zero-based budgeting system.

- Syncs with bank accounts.

- Detailed spending reports.

Pros

- Excellent spending control.

- Strong budgeting discipline.

Ideal For

- Users are serious about tracking daily spending.

- People who want strict budget control.

Why Does It Stands Out?

YNAB stands out as the best budgeting app to track spending because it changes how users think about money.

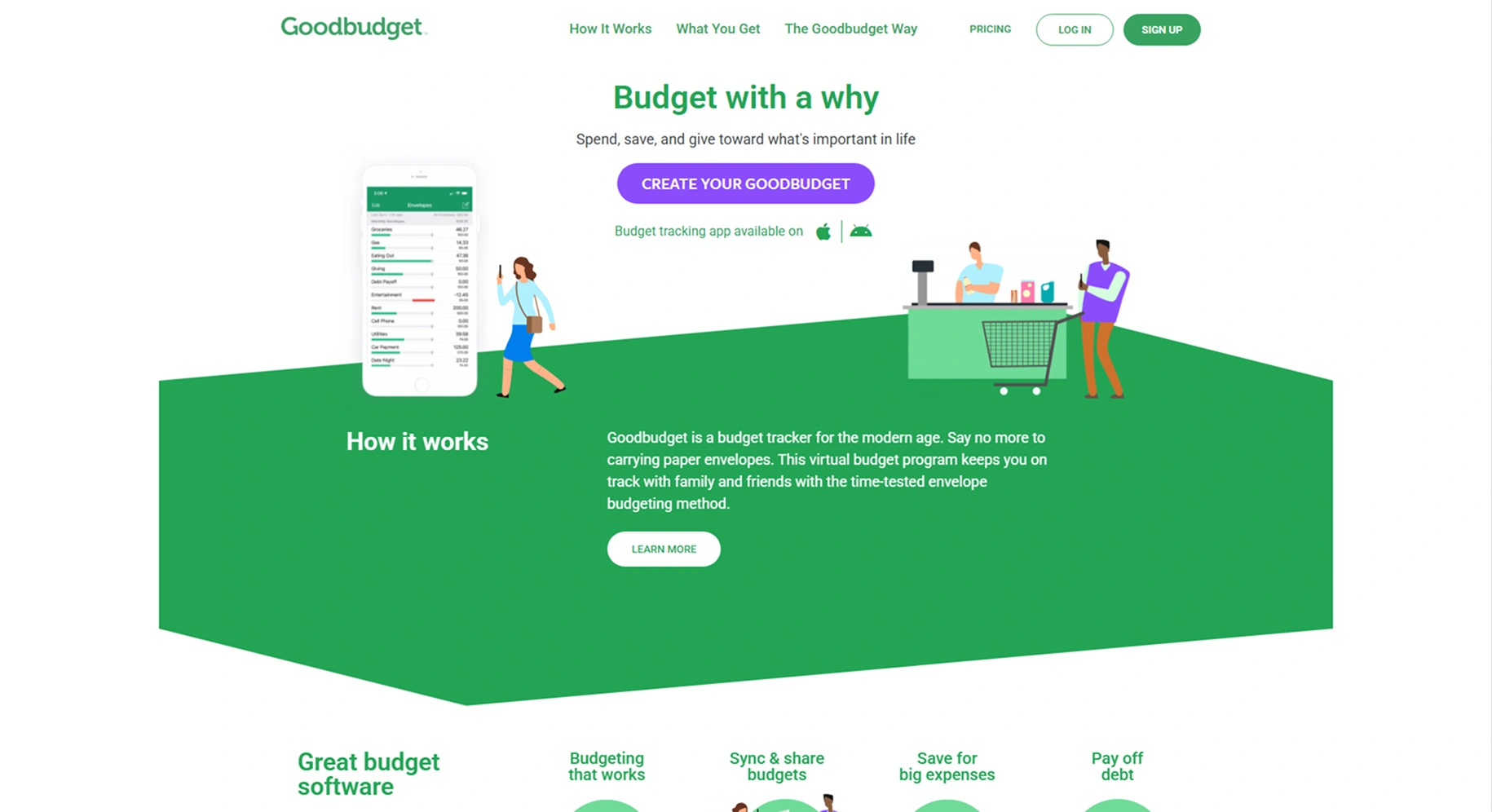

2. Goodbudget: Best Budget Planner App for Beginners

Goodbudget is a simple and effective budget tracker app for beginners.

It follows the envelope budgeting method, making personal budgeting easy to understand.

Simple UI & Setup

- Clean dashboard.

- Easy manual entry.

- Clear budget categories.

Automation Benefits

- Syncs budgets across devices.

- Monthly budget planning.

- Simple expense tracking.

Best Use Cases

- Beginners learning personal budgeting.

- Families managing shared expenses.

Goodbudget works best for users who want a clear personal budget without complex charts or advanced tools.

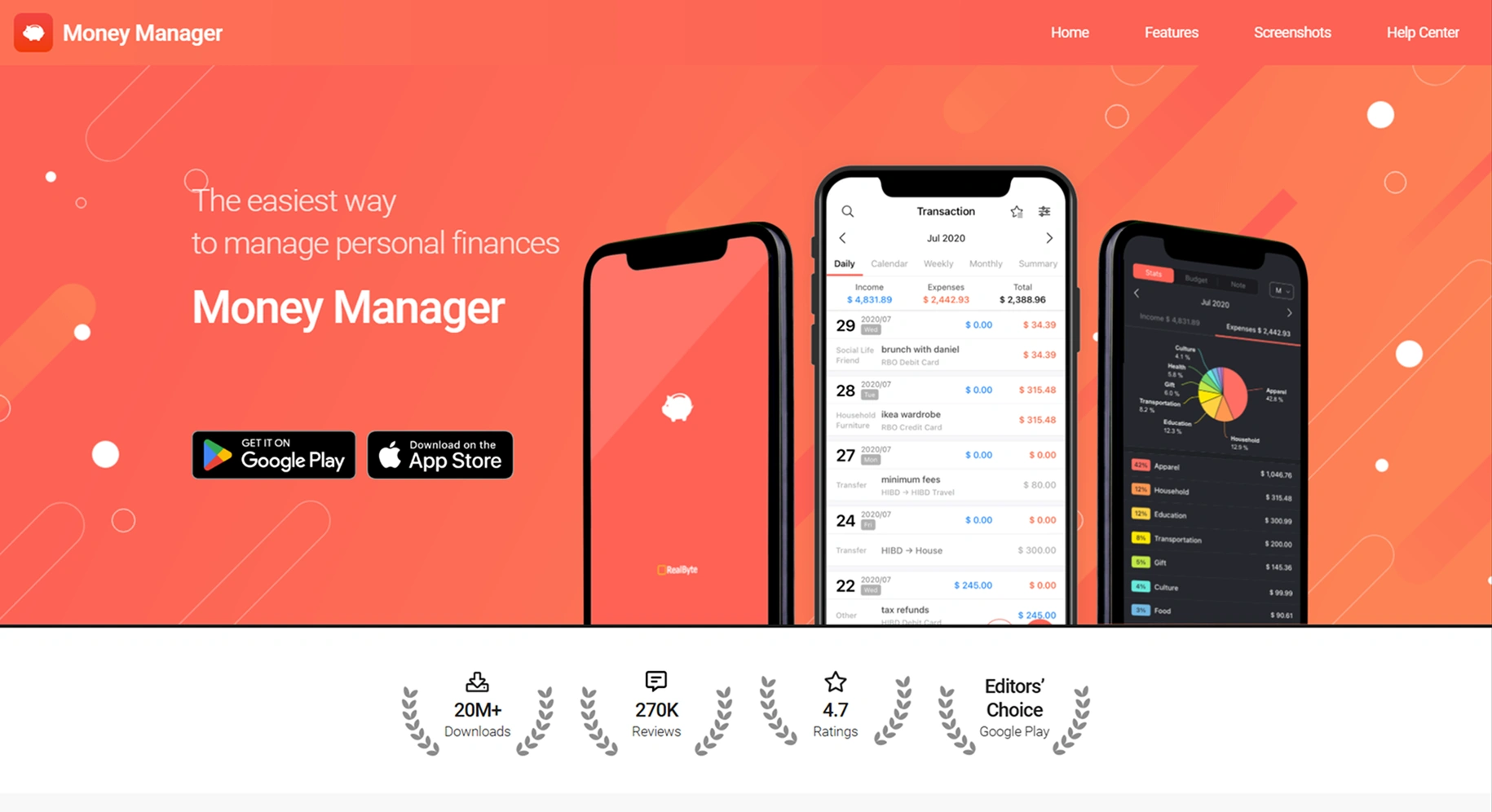

3. Money Manager: Best Free Budgeting App for Personal Finance

Money Manager is one of the most popular free budgeting apps for personal finance, especially among Android users.

What You Get for Free?

- Expense and income tracking.

- Visual charts and reports.

- Daily spending summaries.

Who Should Choose It?

- Users are looking for a simple, free solution.

- People who want offline expense tracking.

This app proves that free budgeting apps can still offer strong value when used consistently.

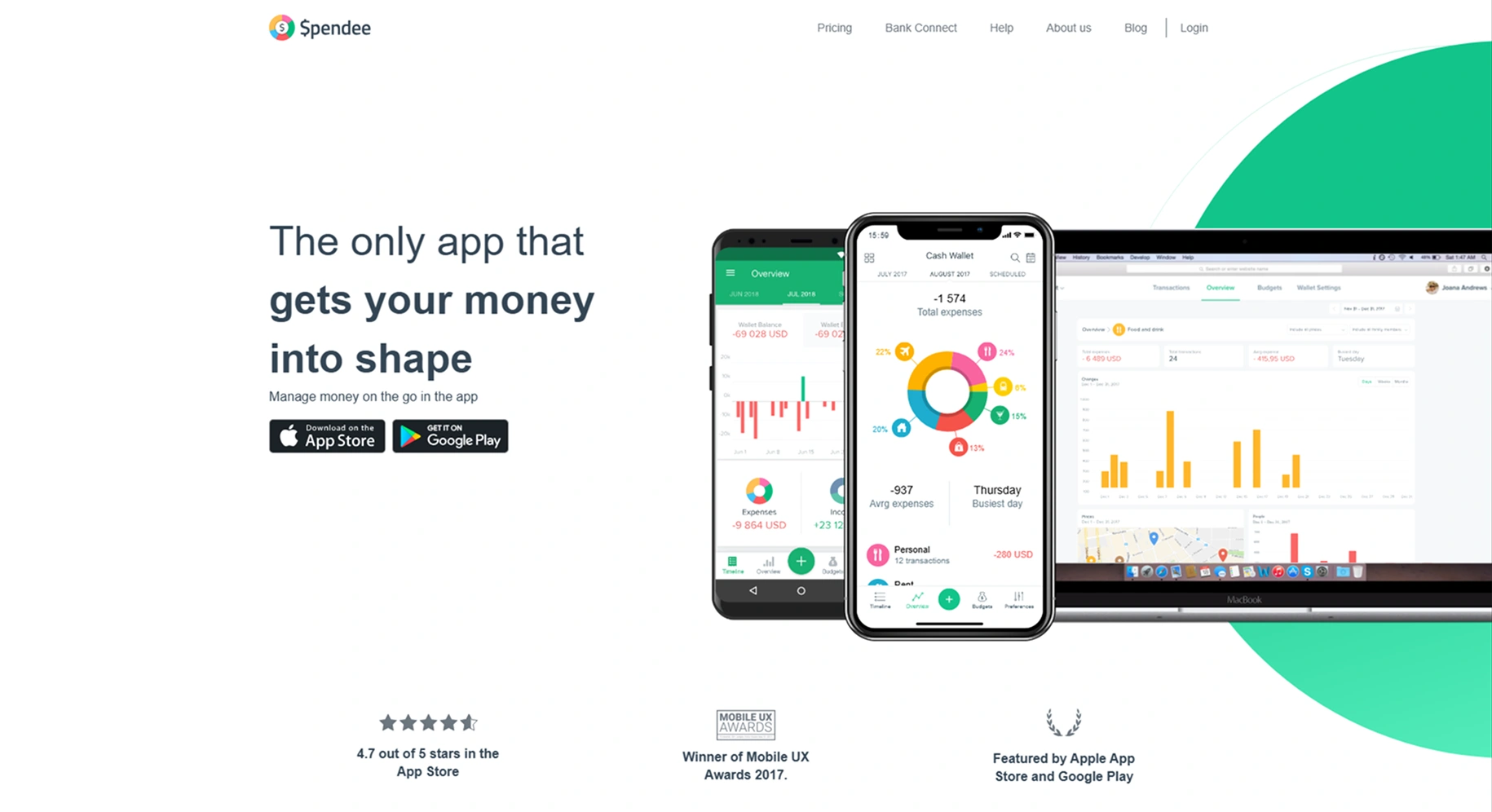

4. Spendee: Best App for Expense Tracking and Savings Goals

Spendee is designed for users who want to save money and track expenses with clear visuals and smart insights.

Goal-Based Budgeting

- Create savings goals.

- Category-wise budgets.

- Alerts for overspending.

Spending Insights

- Weekly and monthly reports.

- Spending trends and patterns.

Long-Term Financial Planning

- Helps users plan future expenses.

- Encourages smart saving habits.

Spendee is ideal for users who want budgeting apps that combine expense tracking with savings goals.

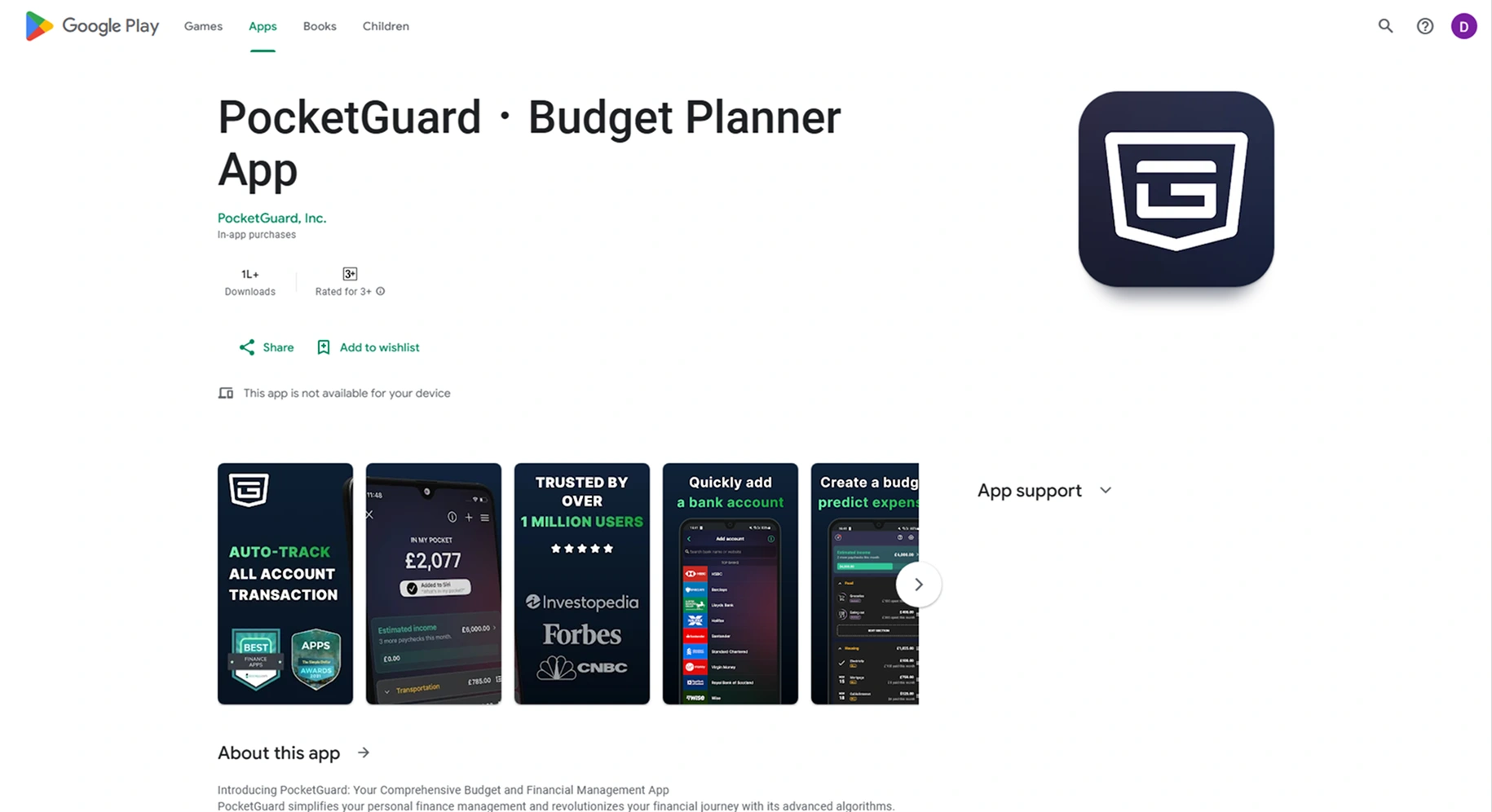

5. PocketGuard: Best Money Management App for Advanced Users

PocketGuard is a smart money management app built for users who want automation and deep insights.

Advanced Analytics

- Smart spending analysis.

- Real-time balance tracking.

- Bill and subscription monitoring.

Custom Budgets

- Personalized budget limits.

- “Safe-to-spend” feature.

Ideal Power Users

- Professionals with multiple expenses.

- Users managing subscriptions and bills.

As a personal finance expense tracker, PocketGuard helps advanced users make confident financial decisions with minimal effort.

Learn more about the Important Features for eLearning App Development.

Quick Comparison Between Top Budgeting Apps

| Budgeting App | Platform (Android / iOS / Web) | Best For | Free vs Premium | Key Budgeting Features |

|---|---|---|---|---|

| YNAB | iOS, Android, Web | Strict budgeting & daily expense tracking | Paid | Real-time expense tracker, zero-based budgeting, detailed reports |

| Goodbudget | iOS, Android, Web | Beginners & families | Free + Premium | Envelope budgeting, shared budgets, simple personal budget setup |

| Money Manager | Android, iOS | Free personal finance tracking | Mostly Free | Expense tracking, spending charts, offline support |

| Spendee | iOS, Android, Web | Savings goals & visual budgeting | Free + Premium | Goal-based budgeting, spending insights, smart categories |

| PocketGuard | iOS, Android, Web | Advanced money management | Free + Premium | Automated tracking, custom budgets, subscription monitoring |

Our Expertise in Budgeting Apps & Expense Tracking Solutions

- We research budgeting and expense tracking apps comparison data to recommend tools that truly help save money.

- Our insights come from building and reviewing real-world money management apps across multiple industries.

- We identify budget planner features that improve expense tracking and financial decision-making.

- Our experts review expense tracker apps to ensure they support realistic budgets and savings goals.

Want a Customized Personal Finance App? Contact Us Today!

How to Choose the Best Budgeting App for Your Personal Finance Goals?

We recommend selecting from the best budgeting apps based on your real-life financial needs.

Choose Based on Income Type

- Fixed-income users benefit from apps like Goodbudget with monthly budgeting.

- Freelancers need flexible apps like YNAB that handle variable income.

- Multiple income streams work best with apps like PocketGuard.

Choose Based on Lifestyle & Spending Habits

- Daily spenders need real-time expense tracking.

- Families benefit from shared budgeting features.

- Minimal spenders may prefer simple personal finance apps.

Apps like Spendee help users visualize spending and stay aware of daily habits.

Choose Based on Savings Goals

- Short-term goals need clear monthly budgets.

- Long-term goals need trend analysis and insights.

- Goal-based budgeting keeps users motivated.

For savings-focused users, Spendee and YNAB are strong choices for structured personal finance planning.

Which Budgeting App Is Right for You?

We believe the best budgeting apps are the ones you’ll actually use consistently. Here’s a quick recommendation based on user type:

- Beginners: Goodbudget, Money Manager

- Savers: Spendee

- Advanced users: YNAB, PocketGuard

The right personal finance app can turn budgeting from a stressful task into a simple daily habit.

FAQs

- The best budgeting app for expense tracking depends on your needs.

- YNAB offers strict spending control, while Spendee provides visual insights that are easy to understand.

- Yes. Most modern personal finance apps use encryption, secure login methods, and privacy controls.

- Apps like PocketGuard and YNAB are known for strong data protection.

- Yes, budgeting apps help users identify overspending, control unnecessary expenses, and stay focused on savings goals.

- Over time, this leads to better financial habits and more savings.

- For beginners, Goodbudget and Money Manager are excellent choices.

- They offer simple setup, clear dashboards, and easy-to-understand budgeting features.