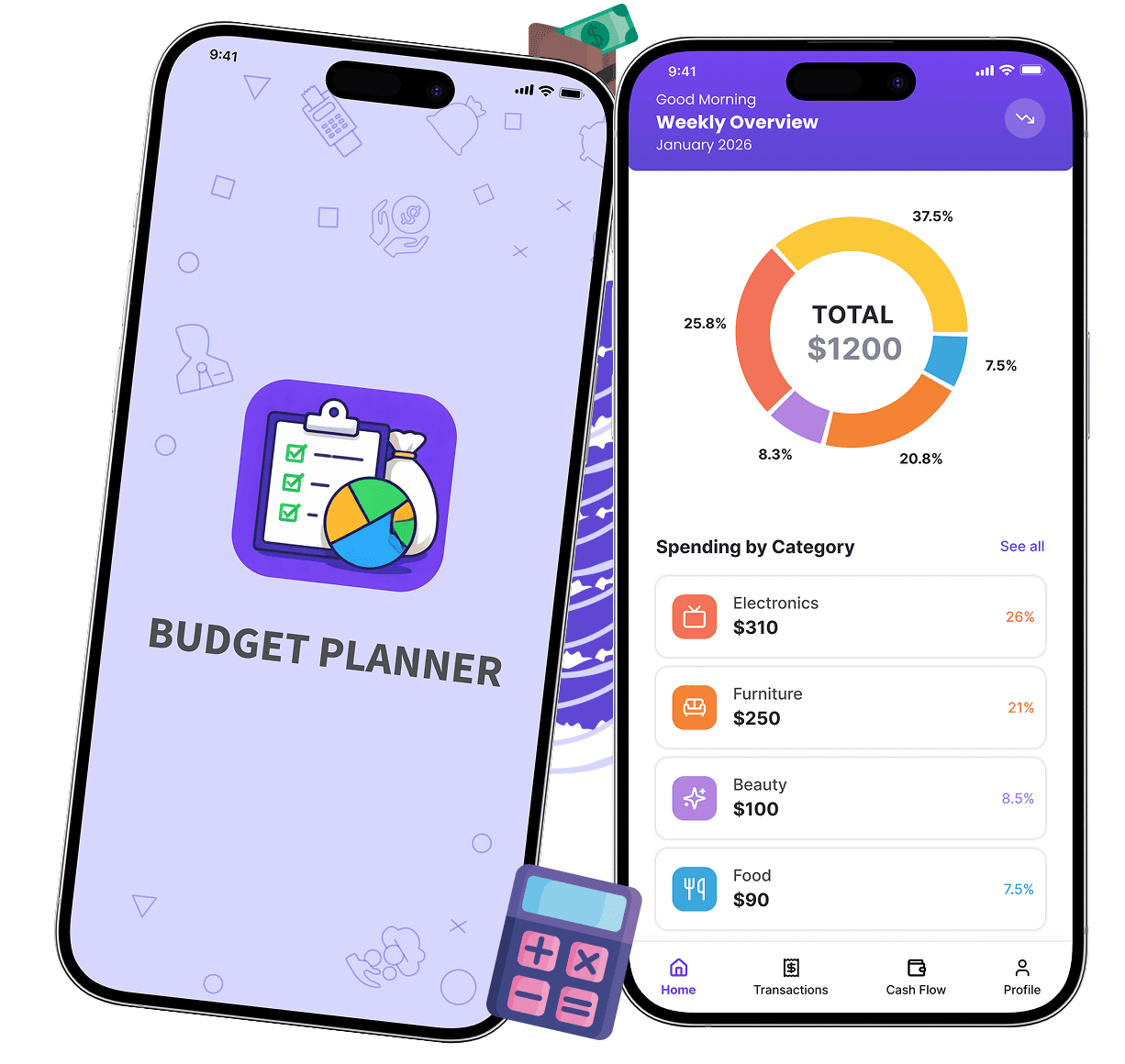

A Smarter Way to Track Expenses, Plan Budgets, and Stay in Control

Managing money shouldn’t feel like a full-time job. Yet for many people, keeping track of daily expenses, monthly budgets, and credit card spending is stressful and confusing.

The Budget Planner app is built to change that.

It’s a modern budget planner app that helps users track spending, plan monthly budgets, and understand their cash flow through clean reports and visual charts.

The app brings everything together into one reliable personal finance management app, so users can focus on making better financial decisions instead of managing spreadsheets.

Client’s Pain Point: Why Managing Money Feels Hard for Most People?

Most users don’t lack discipline; they lack the right tools.

Before using Budget Allocation, people were trying multiple ways to track money, none of which worked well together.

| Life Before Budget Planner App | Life After Budget Planner App |

|---|---|

|

|

The Budget Planner app replaced confusion with clarity through a centralized expense tracking application.

From Chaos to Clarity: How the App Simplifies Money Management?

Instead of forcing users to adapt to complex systems, we built the Budget Planner app around how people actually manage money.

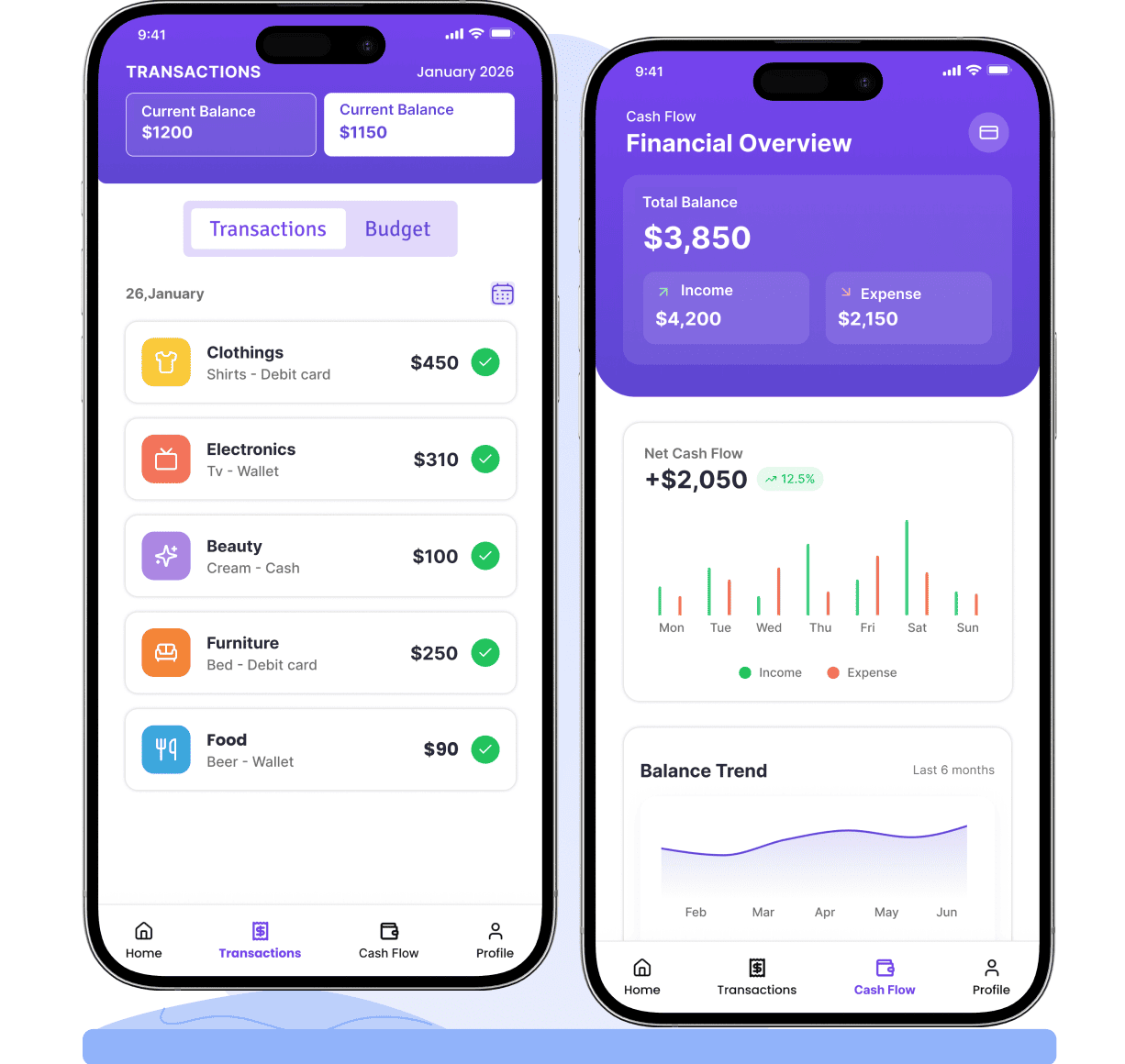

- Everything in One Dashboard: All expenses, budgets, and reports live in a single dashboard. No switching between tools or files.

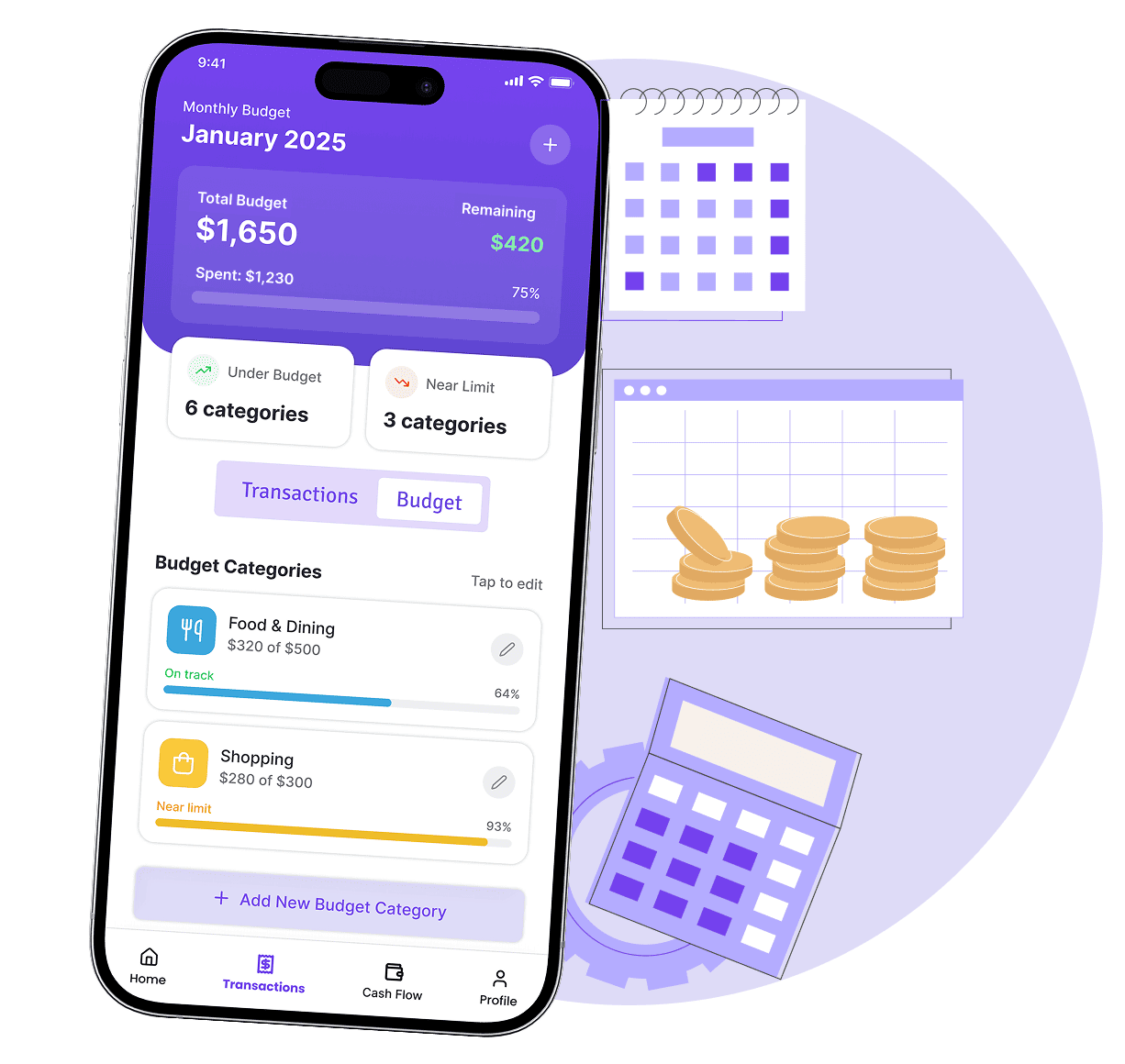

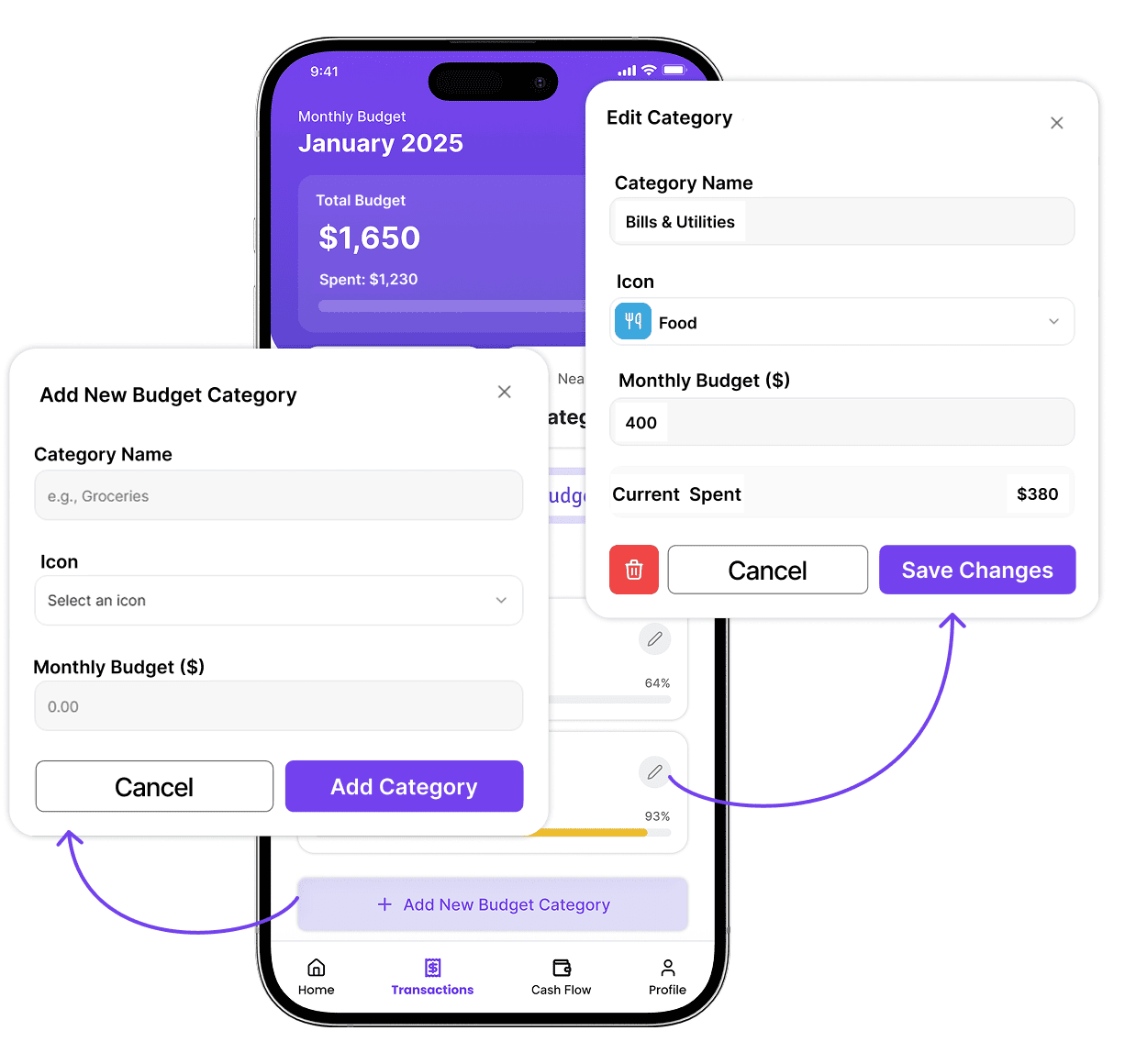

- Budgets That Customize: Users can create a custom monthly budget planner and update it anytime as income or expenses change.

- Instant Updates: Every expense instantly updates totals, reports, and charts. No refresh, no waiting.

- Manage Credit Cards: The app tracks credit card expenses separately so users know exactly how much they’ve spent, before the bill arrives.

- Detailed Reports: Monthly and yearly reports clearly show income vs expenses using easy-to-understand visuals.

This makes the Budget Planner app a complete expense tracking and budget planning software.

What Are the Meaningful Features Built for Real Life, Not Just for Screens?

We focused on features people actually use, not fancy extras they ignore.

- Clean Expense Overview: A simple list view to search, sort, and filter expenses quickly.

- Smart Categories & Tags: Expenses can be grouped by category or tagged for better spending insights.

- Visual Cash Flow Charts: Graphs show where money comes from and where it goes at a glance.

- Helpful Payment Reminders: Never miss a due date with built-in payment alerts.

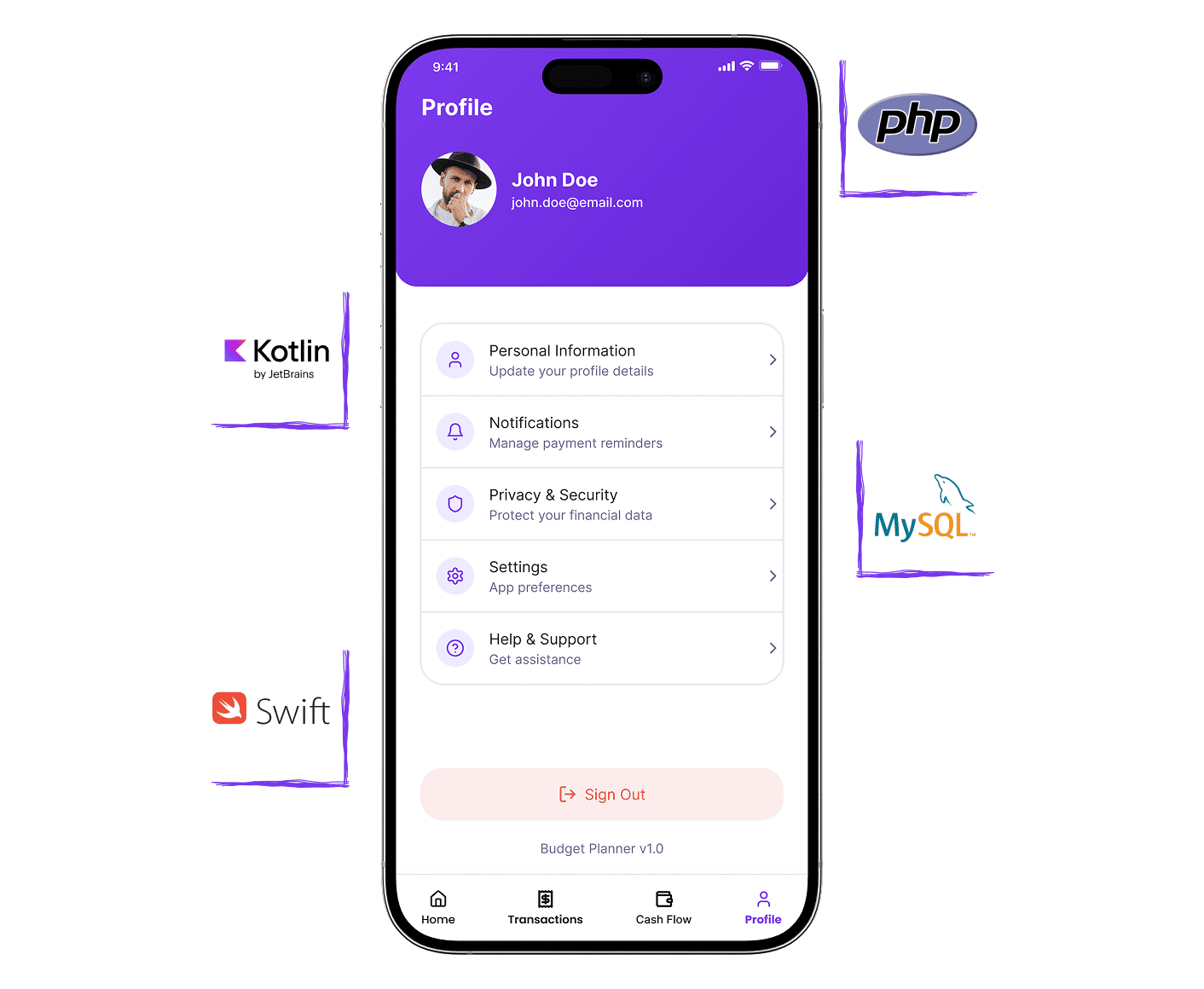

- Works Everywhere: The experience stays smooth and consistent across iOS, Android, and the web.

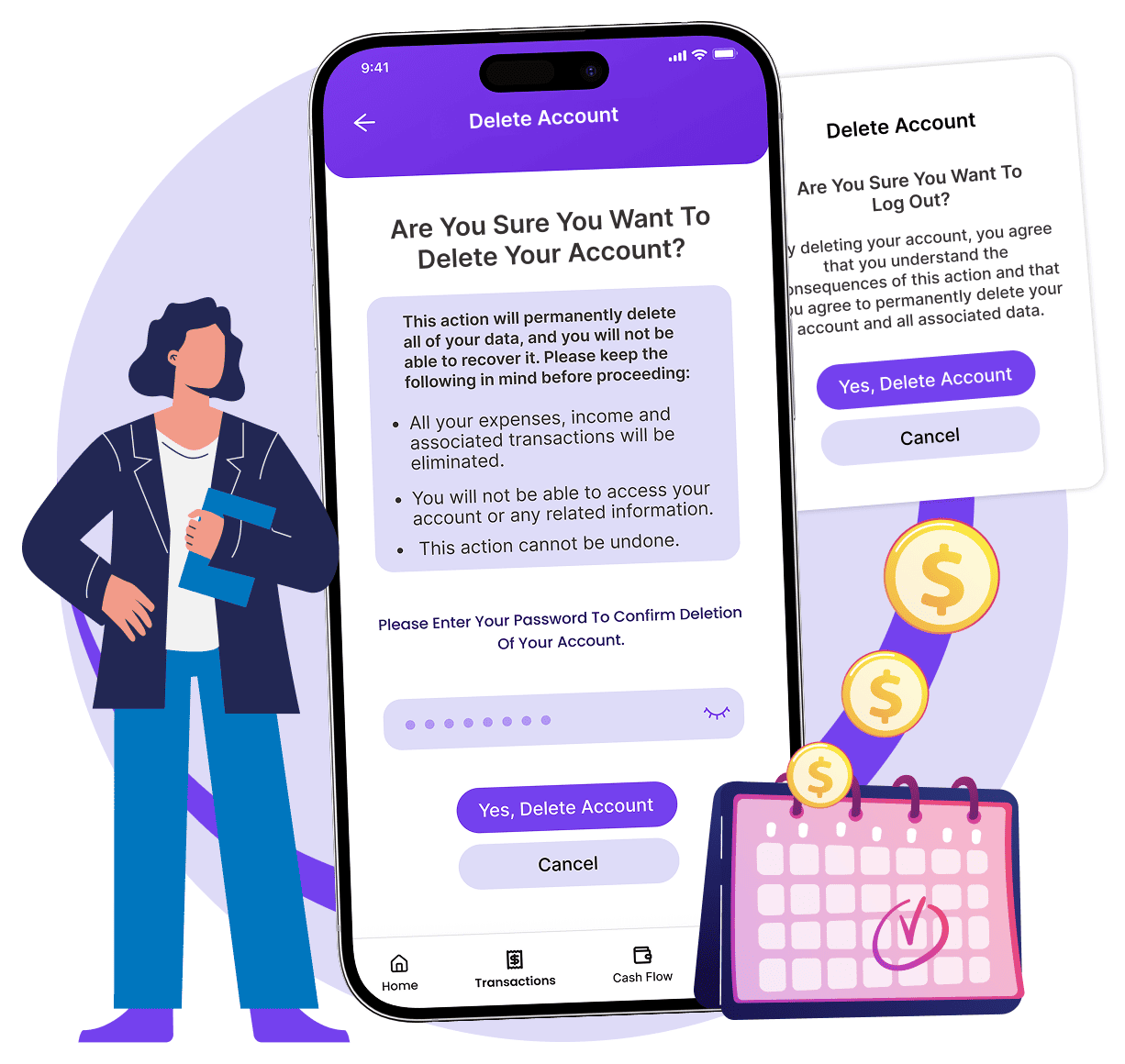

- Privacy Comes First: Strong security measures protect sensitive financial data at every step.

How Useful This Budget Management App Is for Users?

This isn’t just another budgeting app; it solves real problems.

- One Clear View: A single source of truth for all expenses and budgets.

- Better Spending Awareness: Real-time data helps users spend smarter.

- More Control: Monthly budgets reduce overspending naturally.

- Less Manual Work: Automated tracking saves time every day.

- Clear Insights: Graphs turn numbers into understanding.

- Room to Grow: The app is built to scale with user needs.

That’s what makes it a reliable budget management app and personal finance app with real-time reports.

What’s The Tech Behind this App?

The Client’s Experience With the App

Seven Square helped us turn a complex idea into a simple and effective budget planner app.

The app works as a complete monthly budget planner with expense categorization and real-time insights.

Users now rely on the personal finance app to track spending, control budgets, and avoid overspending on credit cards.

The experience has been smooth across mobile and web platforms.

Got a project? Let’s talk.

We’re a team of creative tech-enthus who are always ready to help business to unlock their digital potential. Contact us for more information.