AI in Fintech Software helps fintech startups scale faster.

By automating onboarding, fraud detection, credit scoring, compliance, and customer engagement using machine learning and intelligent decision systems.

- AI automates high-risk and high-volume financial workflows.

- AI-powered fintech tools reduce operational cost.

- AI risk models improve approval accuracy.

- AI personalization increases customer retention.

- AI analytics enables faster strategic decisions.

Fintech startups using AI fintech solutions scale operations faster with lower risk and higher margins.

If you want to implement AI in your fintech platform, we can design and deploy a production-ready AI fintech architecture.

What AI in Fintech Software Does for Startup Scaling?

AI in fintech software becomes a scaling engine for fintech startups. Here is what AI for fintech startups actually does:

- Automates KYC and onboarding verification.

- Allows AI-enabled fraud detection in fintech systems.

- Improves credit scoring using behavioral data.

- Reduces manual compliance checks.

- Powers real-time transaction monitoring.

- Delivers personalized fintech services using AI.

- Improves fintech efficiency with intelligent automation.

AI replaces slow, manual, rule-based fintech workflows with adaptive, data-driven decision systems.

That is why AI for financial technology scaling is now considered core infrastructure.

What Growth Bottlenecks AI Removes in Fintech Software?

Most fintech startup scaling problems come from operational friction. AI fintech automation removes:

- Slow customer onboarding pipelines.

- Fraud, false positives, & blocking approvals.

- Manual underwriting queues.

- Compliance review delays.

- Risk misclassification.

- Support overload.

- Poor targeting and personalization.

How does AI improve fintech efficiency?

AI models process thousands of data points instantly, something human teams cannot scale.

Learn How Financial Dashboard Software Improves Decision-Making.

Why Fintech Startups Cannot Scale Without AI Anymore?

Traditional fintech software breaks under growth pressure. Without AI fintech solutions:

- Manual reviews slow onboarding.

- Static fraud rules miss new attack patterns.

- Compliance teams become bottlenecks.

- Underwriting decisions remain inconsistent.

- Customer segmentation remains weak.

- Risk scoring lacks predictive depth.

Traditional Fintech vs AI-Powered Fintech Tools

Traditional systems

- Rule-based.

- Human dependent.

- Reactive.

- Slow to adapt.

AI-powered fintech tools

- Pattern learning.

- Automated decision-making.

- Predictive.

- Continuously improving.

Result: Machine learning in financial services enables scale without proportional team growth.

How AI Helps Fintech Startups Scale Faster?

Here you can see the main use of AI in Fintech software & how you can maximize AI for Fintech startup:

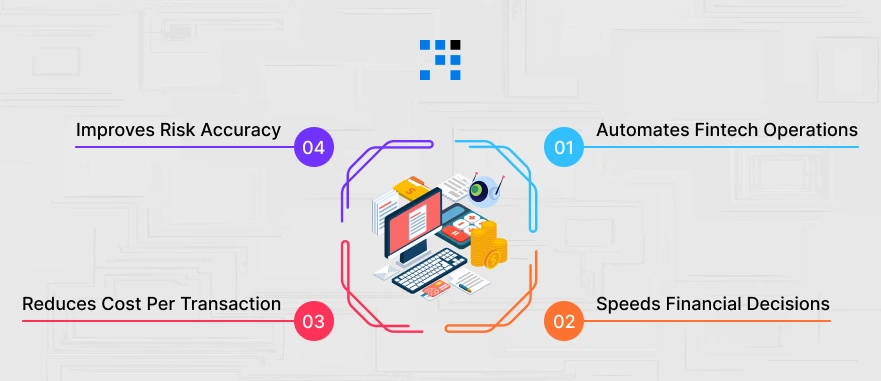

1. How AI Automates Fintech Operations?

AI in fintech software automates:

- KYC document validation.

- Identity matching.

- Transaction monitoring.

- AML screening.

- Compliance flagging.

This reduces manual processing cost and speeds approvals.

2. How AI Speeds Financial Decisions?

AI for fintech startups allows:

- Real-time credit scoring.

- Behavioral risk prediction.

- Instant loan eligibility decisions.

- Dynamic underwriting.

Example: Instead of 24-hour approval cycles, AI models return decisions in seconds.

3. How AI Reduces Cost Per Transaction?

AI fintech automation reduces:

- Manual review of labor.

- Fraud loss exposure.

- Compliance overhead.

- Support staffing needs.

This directly improves unit economics, which is important for startup scaling.

4. How AI Improves Risk Accuracy?

AI risk management in fintech uses:

- Behavioral modeling.

- Network fraud detection.

- Pattern anomaly detection.

- Adaptive scoring.

AI-enabled fraud detection in fintech catches emerging fraud patterns faster than rule engines.

How Do We Implement AI in Fintech Software?

We follow a practical AI fintech delivery framework:

How Do We Deliver AI Fintech Solutions?

- AI readiness and data audit.

- Use-case prioritization.

- Fintech AI architecture design.

- ML model integration.

- Compliance-aware AI pipelines.

- Scalable cloud AI infrastructure.

- Continuous model learning loops.

We specialize in integrating AI into fintech software platforms without disrupting live operations.

Want to Build Your AI-Powered Fintech Platform? Contact Us Now!

What Real Fintech Teams Are Using AI For Today?

Across fintech communities and founder discussions, common AI use cases appear repeatedly:

- AI fraud detection systems are reducing chargebacks.

- Machine learning credit scoring for thin-file users.

- AI personalization is improving fintech app retention.

- AI underwriting reduces default risk.

- AI compliance monitoring lowers audit load.

AI fintech trends show the strongest ROI in fraud, credit, onboarding, and personalization.

How AI Improves Customer Experience in Fintech Apps?

Scaling is not just backend; it is customer experience. How AI improves customer experience in fintech apps:

- Personalized financial insights.

- Smart saving and spending alerts.

- AI chat financial assistants.

- Predictive customer support.

- Dynamic product recommendations.

AI-powered fintech tools increase engagement and lifetime value.

What Happens When AI Is Missing in Fintech Systems?

Without AI in fintech software:

- Slower onboarding.

- Higher fraud leakage.

- Poor personalization.

- Rising ops cost.

- Slower scaling.

With AI fintech solutions:

- Real-time approvals.

- Lower fraud risk.

- Personalized journeys.

- Lower cost per user.

- Faster growth.

If you delay AI adoption, AI-enabled competitors will scale faster than you.

How to Start AI Implementation in Your Fintech Product?

Step-by-step AI fintech adoption plan:

- Audit your fintech workflows.

- Identify high-impact AI use cases.

- Start with fraud, risk, or onboarding AI.

- Integrate ML models into decision flows.

- Measure performance lift.

- Expand AI coverage gradually.

Best starting point: AI-based fraud detection or AI credit scoring.

The Fintech Startups That Scale Fast Will Be AI-Powered

AI in fintech software is now a scaling multiplier. Startups that adopt AI:

- Scale faster.

- Operate leaner.

- Detect risk earlier.

- Personalize better.

- Compete stronger.

Startups that delay AI adoption fall behind data-driven competitors.

FAQs

- Faster scaling, lower risk, automation, personalization, and improved financial decision accuracy.

- By automating approvals, reducing fraud, improving targeting, and enabling real-time analytics.

- Fraud detection, onboarding automation, and risk scoring deliver the fastest ROI.

- Data quality, compliance alignment, model governance, and integration complexity.