Over 75% of leading banks are adopting AI-based solutions to improve efficiency, reduce errors, and provide a better customer experience.

Among these innovations, Agentic AI in banking is coming out as a game-changer. Agentic AI acts autonomously to execute tasks, make decisions, & optimize banking operations.

We are seeing how AI banking automation can change everyday banking processes.

From automating loan approvals to real-time fraud detection, the benefits of Agentic AI in banking are delivering measurable results for institutions worldwide.

In this blog, we’ll explore what Agentic AI is, why it’s different from conventional banking AI, & practical steps banks can take to implement it successfully.

This blog is for you if you are trying to get an Agentic AI banking solution to get the best results.

What is Agentic AI in Banking?

Agentic AI in banking is an advanced form of artificial intelligence capable of performing complex banking tasks independently.

Agentic AI can analyze data, make decisions, and execute actions autonomously.

- For example, traditional banking AI might flag a suspicious transaction and alert a human analyst.

- In contrast, Agentic AI vs traditional banking AI allows the system to immediately block fraudulent activity, notify customers, & report compliance issues, all in real-time.

We understand what Agentic AI in banking truly is.

It’s about creating a system that actively drives efficiency, minimizes human error, and improves customer experience while ensuring regulatory compliance.

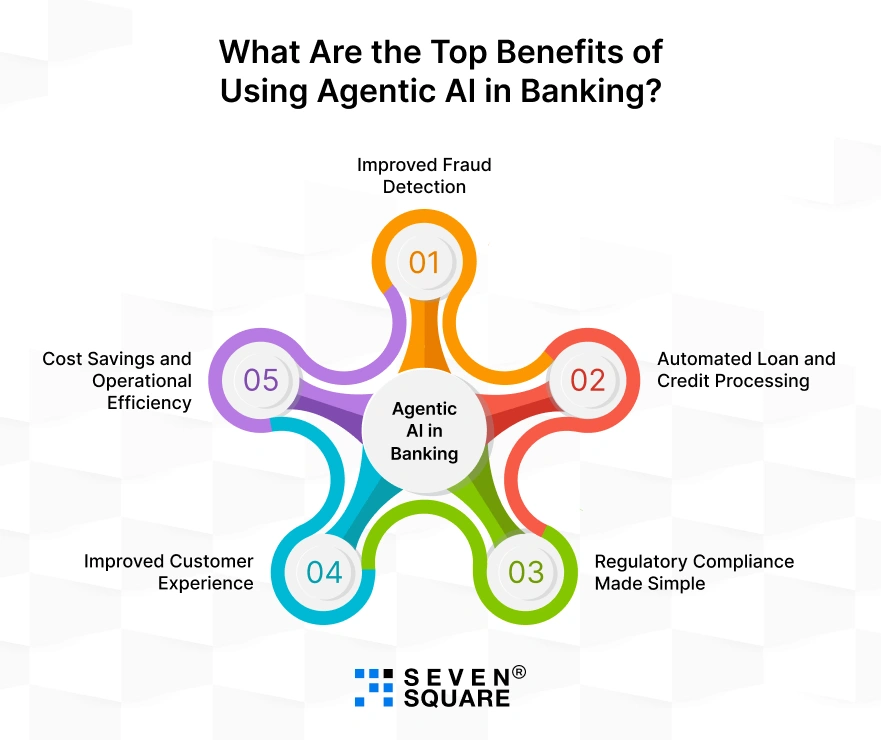

What Are the Top Benefits of Using Agentic AI in Banking?

We’ve seen how Agentic AI in banking simplifies operations, customer interactions, and decision-making.

From reducing errors to improving efficiency, the real-world advantages are undeniable. Here’s a closer look at the top benefits:

1. Improved Fraud Detection

- Fraud remains one of the biggest challenges for banks today.

- Agentic AI for fraud detection in banking goes beyond traditional systems by enabling real-time fraud detection.

- Agentic AI can autonomously block fraudulent transactions, alert customers immediately, and generate compliance reports.

- With our expertise, banks can implement solutions that actively prevent losses, minimize risk, and strengthen trust with customers, all through intelligent, automated monitoring.

2. Automated Loan and Credit Processing

- Processing loans and credit approvals manually is time-consuming and prone to errors.

- Agentic AI for loan processing speeds up the approval workflow while improving accuracy.

- It can analyze credit histories, assess risks, and deliver decisions faster than traditional systems.

- Similarly, Agentic AI for credit scoring helps banks make data-driven lending decisions, reducing defaults and improving portfolio quality.

- We help banks implement these AI-based processes, enabling faster approvals, higher efficiency, and happier customers.

3. Regulatory Compliance Made Simple

- Compliance is a top concern for financial institutions.

- Agentic AI for compliance in banking ensures that all processes stick to regulations automatically.

- From KYC (Know Your Customer) checks to anti-money laundering reporting, AI monitors transactions and generates alerts in real-time.

- By using Agentic AI for regulatory compliance in banking, banks reduce human error, avoid penalties, and maintain operational integrity.

- We ensure that compliance automation is smooth, accurate, and continuously updated with changing regulations.

4. Improved Customer Experience

- Customers today expect fast, personalized, and 24/7 service.

- Agentic AI for customer experience in banking makes this possible by delivering personalized recommendations, AI-based chatbots, & intelligent support systems.

- Banks can use Agentic AI for personalized banking services to offer personalized financial advice, suggest relevant products, and respond instantly to queries.

- We guide banks to use AI to create loyal, satisfied customers while reducing operational workload.

5. Cost Savings and Operational Efficiency

- Manual banking processes are costly and error-prone.

- Implementing AI banking automation reduces operational costs, eliminates repetitive tasks, and minimizes mistakes.

- With Agentic AI banking solutions, banks can optimize staff time, simplify workflows, and achieve significant savings.

- We help institutions deploy these AI systems efficiently, ensuring maximum return on investment and smoother day-to-day operations.

How Banks Can Implement Agentic AI Successfully?

Implementing Agentic AI in banks can be difficult. We guide financial institutions through a step-by-step process to ensure smooth integration and measurable results.

1. Assess Current Processes and Pain Points

- Identify inefficiencies in operations, customer service, credit scoring, loan processing, fraud detection, and compliance.

- Understanding these pain points helps in choosing the right solution.

2. Choose the Right Agentic AI Banking Solutions

- Select solutions customized according to your bank’s needs, whether for credit scoring, automated loan approvals, fraud detection, or regulatory compliance.

- Partner with experts who understand both AI technology and banking requirements.

3. Integrate with Existing Banking Systems

- Ensure smooth integration with core banking systems, CRM platforms, and compliance tools.

- Proper integration avoids disruption and allows AI-driven banking automation to function effectively.

4. Train Staff and Monitor Performance

- Equip employees with knowledge to work alongside Agentic AI.

- Continuous monitoring ensures the system adapts to changing conditions and improves over time.

5. Measure ROI and Optimize Continuously

- Track key metrics like process efficiency, cost savings, error reduction, and customer satisfaction.

- Regular optimization ensures your investment in Agentic AI implementation in banks delivers maximum returns.

For banks looking to stay competitive, implementing Agentic AI for credit scoring in banks and other automated processes is key.

Our team helps businesses to go through this transition, ensuring AI adoption is strategic, secure, and scalable.

What Are the Challenges & Considerations When Using Agentic AI?

While the benefits of Agentic AI banking solutions are substantial, banks must be aware of certain challenges before implementation:

- Data Privacy & Security: Financial data is highly sensitive. Ensuring that Agentic AI systems comply with privacy regulations and safeguard customer information is crucial.

- Integration Complexity: Merging Agentic AI with existing banking systems can be complex. Proper planning and phased integration help avoid disruptions.

- Staff Training & Change Management: Employees need training to work alongside AI systems. Change management ensures smooth adoption and maximizes AI’s impact.

Our approach ensures that Agentic AI has a positive impact on banking operations, better efficiency, reduces errors, and improves customer satisfaction.

Want to Integrate AI in Your Fintech Solution? Contact Us Now!

What’s Next for Agentic AI in Banking?

The future trends of Agentic AI in the banking industry are creating its next frontier:

- Predictive Analytics: AI will anticipate customer needs and financial risks before they arise.

- Hyper-Personalization: Banks will offer personalized recommendations and services for each customer, powered by real-time data.

- AI-Based Advisory: Agentic AI will support financial advisors by providing insights, portfolio management, and investment strategies automatically.

With AI banking automation, banks can stay competitive, improve decision-making, and deliver the best customer experiences.

Why Your Bank Can’t Ignore Agentic AI?

Agentic AI in banking is slowly becoming a necessity. By implementing Agentic AI banking solutions, banks can:

- Improve efficiency across operations.

- Deliver personalized customer experiences.

- Better fraud detection and compliance.

- Reduce costs and operational errors.

We help banks to use the full benefits of Agentic AI in banking, ensuring solutions are secure, scalable, and aligned with business goals.

FAQs

- Agentic AI monitors transactions in real-time, autonomously blocks suspicious activity, and generates compliance alerts to reduce fraud.

- Yes, Agentic AI for loan processing analyzes credit data, assesses risks, and delivers fast, accurate approvals.

- Agentic AI in banking can scale for small, medium, or large banks, offering cost-effective automation and operational efficiency for all.

- Risks include data security, integration challenges, and staff training.

- These are minimized with secure, integrated, and user-friendly Agentic AI banking solutions.