A Modern Insurance Policy Authentication System for Operational Efficiency

Insurance companies deal with high volumes of insurance policies that require accuracy, security, and accountability at every stage.

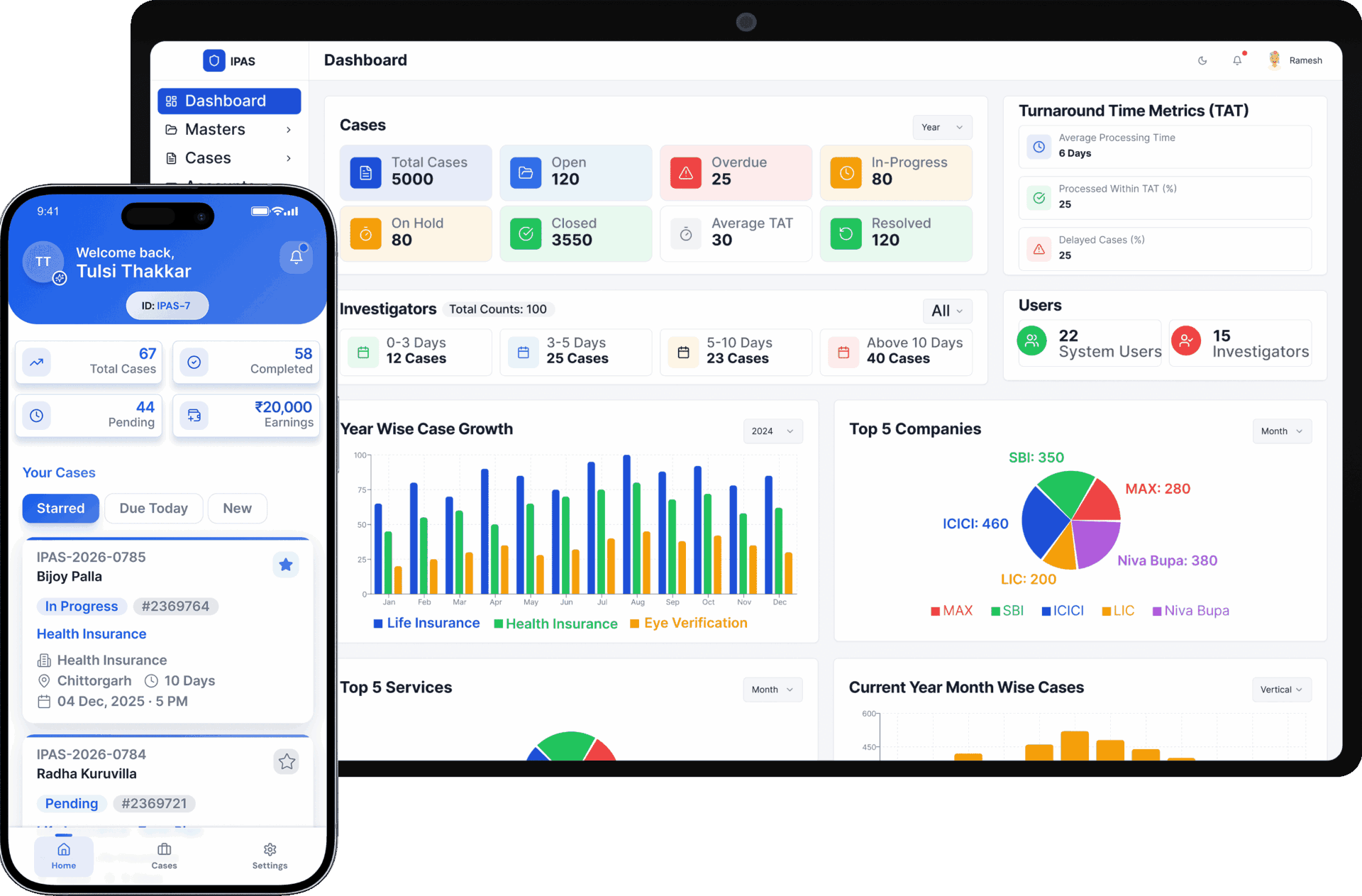

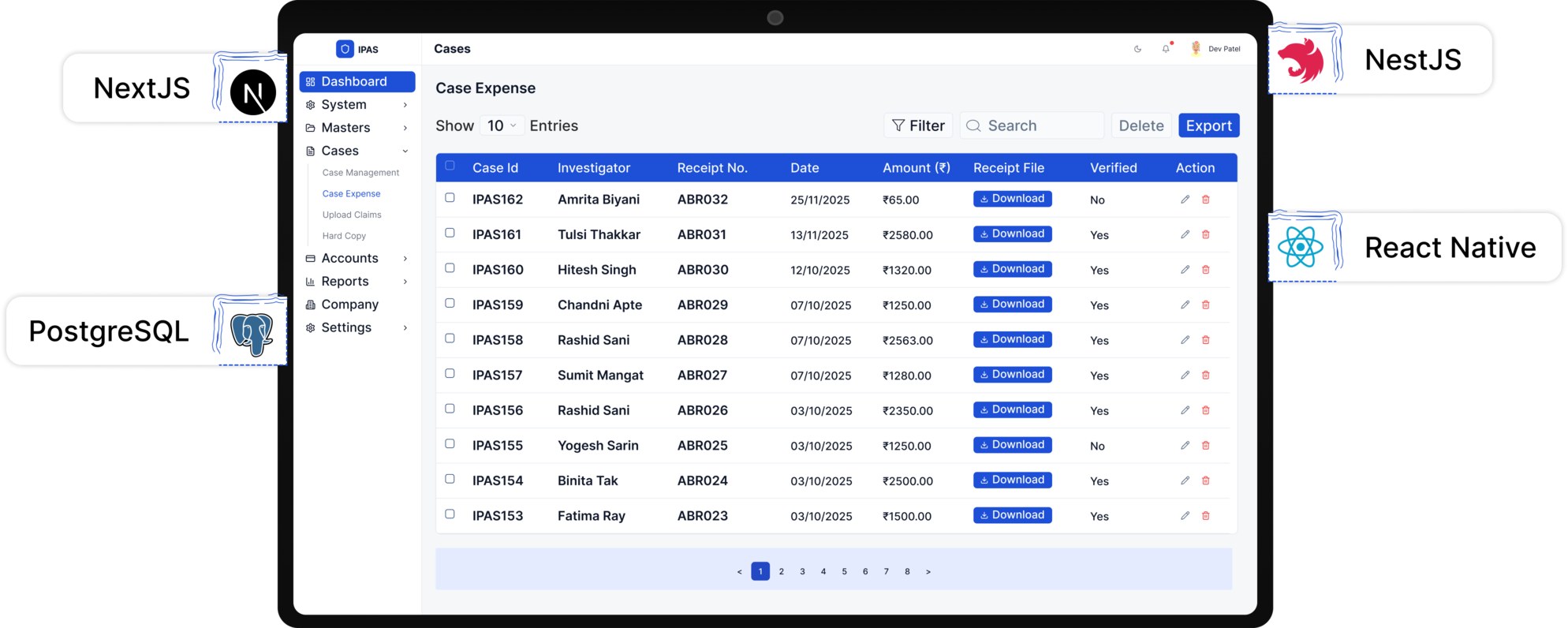

IPAS (Insurance Policy Authentication System) is built to digitize and simplify the entire insurance verification lifecycle.

It acts as a centralized insurance policy verification system, validators, admins, and management onto a single secure platform.

Pain Area of Client: Why Is a Unified Insurance Policy Authentication System Needed?

Managing insurance policies using Excel sheets, WhatsApp messages, and emails quickly becomes difficult.

| Before IPAS | After IPAS |

|---|---|

|

|

IPAS replaced all of this with a centralized Insurance Policy Authentication System that manages everything in one place.

It provides complete visibility, control, and security across the entire insurance policy authentication process.

How Does IPAS Automate Insurance Policy Management from Start to Finish?

Traditional manual workflows cannot handle the complexity of modern insurance policies. IPAS improves operational efficiency by providing:

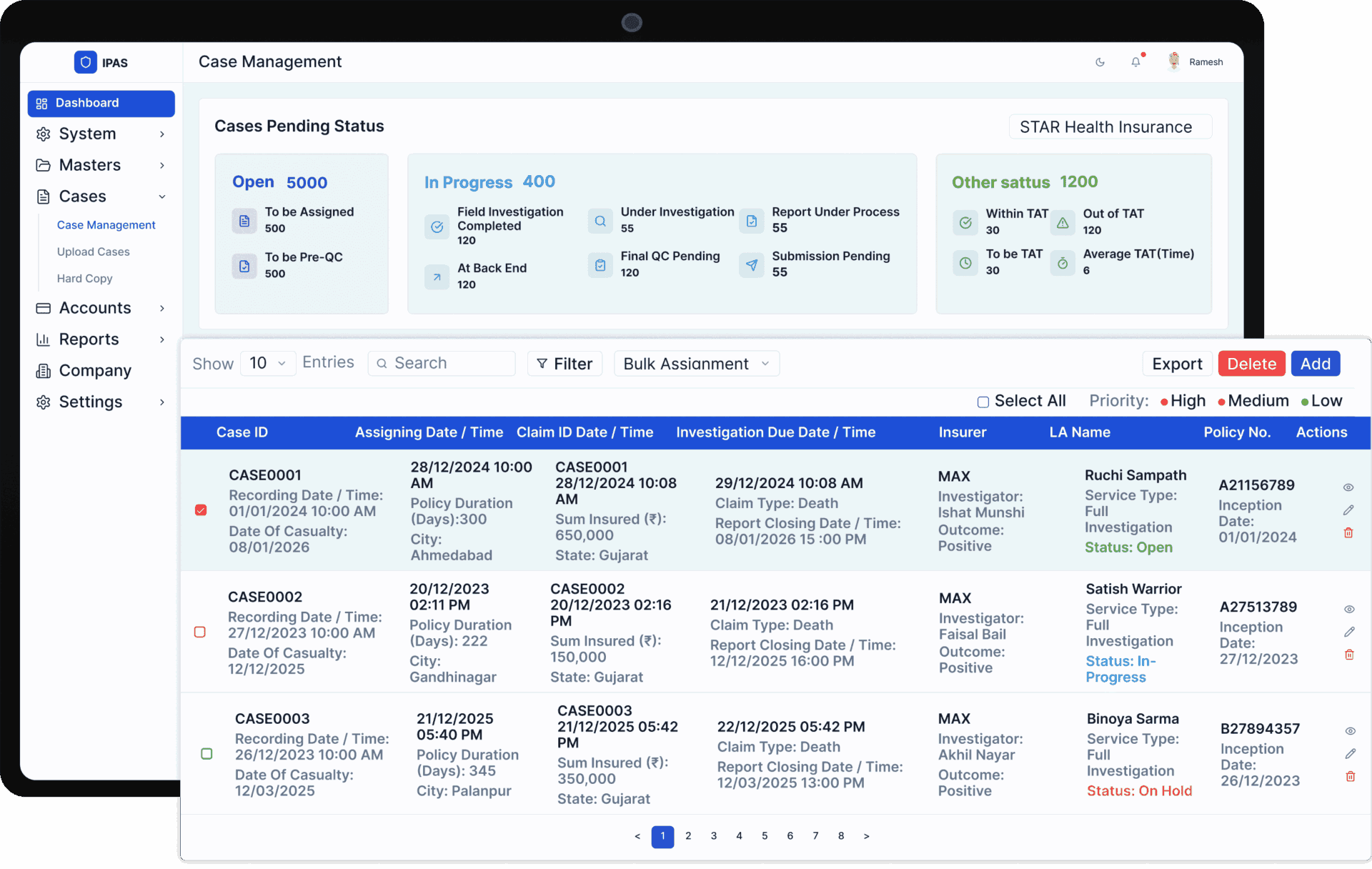

- Centralized Policy Control: All insurance policies are stored in a single dashboard with structured data fields, statuses, and role-based visibility.

- Multi-Stage Policy Workflows: Policies move through dynamic, step-based forms that allow forward & backward navigation based on missing or invalid information.

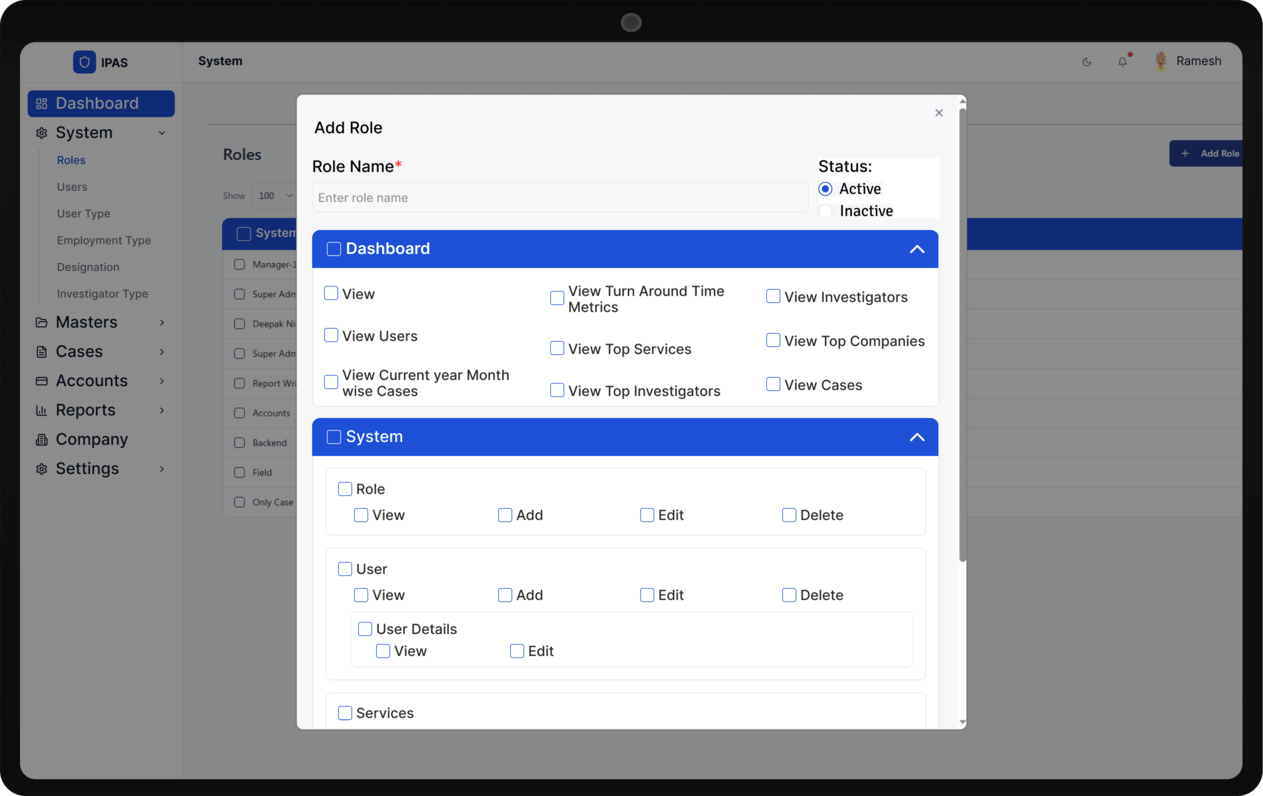

- Role-Based Policy Validation: Each user role can view, modify, or approve specific stages of a Policy using permission-based access control.

- Real-Time Policy Updates: Live updates ensure admin teams always see the latest policy status without manual follow-ups.

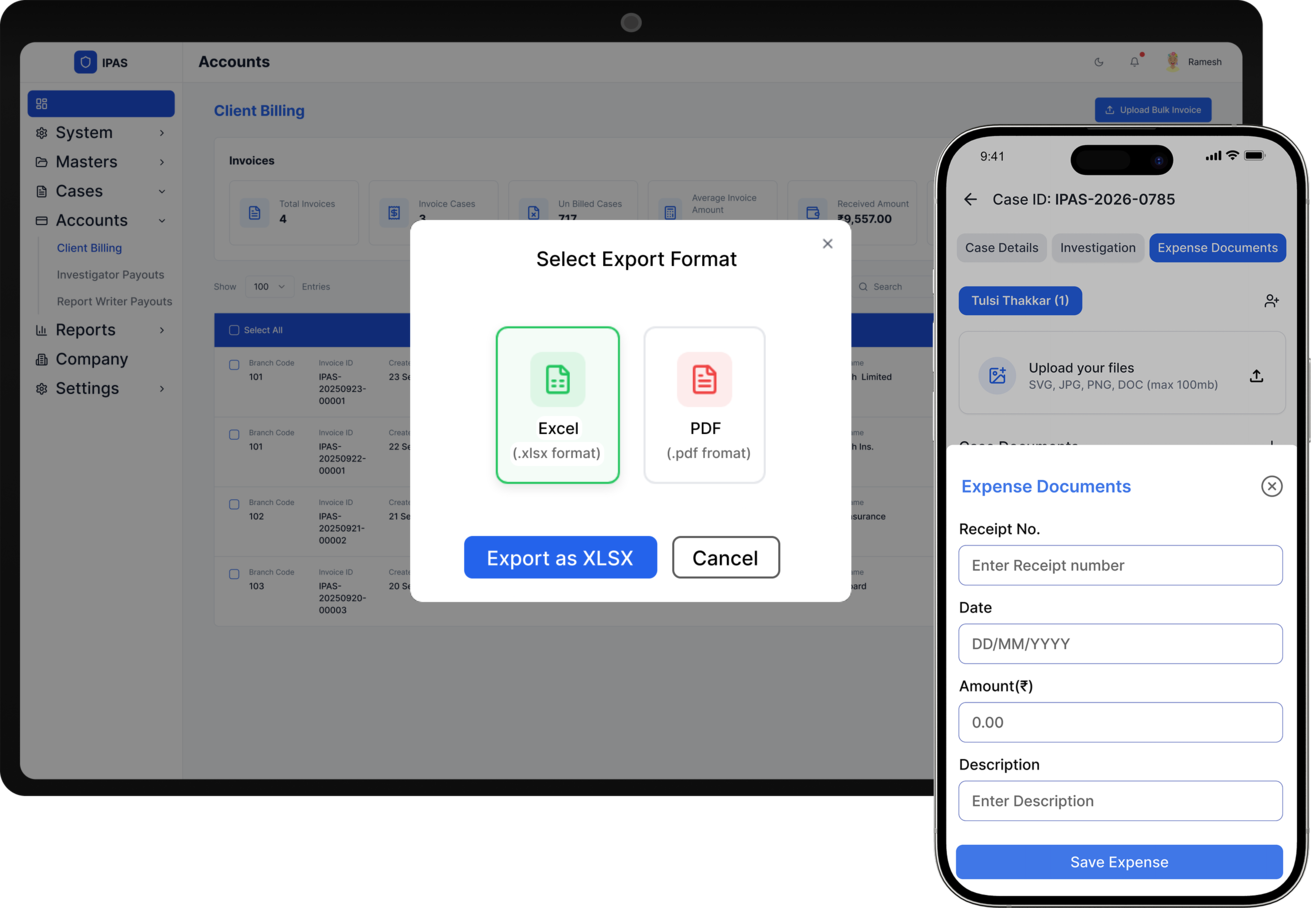

- Automated Reports & Invoices: Generate policy reports and invoices directly from the system for faster processing and billing.

IPAS is a complete insurance policy management system.

What Are the Advanced Features for Insurance Policy Authentication?

We developed IPAS, an insurance policy authentication platform with powerful features:

- Advanced Policy Management Dashboard: A clean, structured interface for viewing, filtering, and managing hundreds of insurance policies efficiently.

- Field-Level Permission Control: Each form field supports role-based permissions, ensuring sensitive data is accessed only by authorized users.

- Real-Time Synchronization: Instant updates across users using Socket.IO for smooth coordination between validators.

- Audit Trails & Policy History: Every change is logged with user details, timestamps, and version history for full accountability.

- Role-Based Access Control (RBAC): Secure access management for validators, admins, and management using JWT authentication.

- Secure Document Management: Upload and manage policy documents, invoices, and reports using cloud storage.

Key Advantages of Insurance Policy Authentication Platform

- Single Source of Truth: One centralized system for all insurance policies.

- Improved Accuracy: Validation rules reduce manual data errors.

- Better Transparency: Every role works with the same real-time policy data.

- Faster Policy Closures: Reduced dependency on calls, messages, and manual follow-ups.

- Complete Auditability: Detailed logs ensure regulatory and compliance readiness.

- Future-Ready Scalability: Easily extend workflows, forms, and roles as requirements increase.

With these benefits, IPAS works as a complete Insurance Policy Authentication & Policy Verification Software.

Technologies We Used to Build IPAS

Words From the Client

Our experience with Seven Square has been extremely positive.

They helped us replace a manual, unorganized process with a modern insurance policy authentication system.

IPAS brought all insurance policy data, documents, and workflows into a single, easy-to-use platform.

The insurance policy authentication software supports multi-stage policy processing, role-based approvals, and real-time status updates, which reduces dependency on calls and follow-ups.

Secure document uploads, audit logs, and permission-based access improved transparency and compliance.

IPAS has reduced manual effort and improved turnaround time. It now plays an important role in daily insurance verification.

Got a project? Let’s talk.

We’re a team of creative tech-enthus who are always ready to help business to unlock their digital potential. Contact us for more information.