In the past, it was difficult to manage personal finances & access banking services while waiting in long queues or by using outdated apps.

But now it has been changed. With open banking APIs, the financial industry is going through a major change.

Open banking is all about giving users more control over their financial data with secure access through third-party apps.

This change has opened opportunities for fintech startups from budgeting apps and digital wallets to investment platforms and neobanks.

At the core of this change depends upon one important tool: the banking API.

A banking API works as a bridge between banks and fintech apps to share data securely and quickly.

It allows developers to build smarter, faster, and more user-friendly financial services.

Whether it’s checking your balance in a budgeting app or getting a loan approval within minutes, it is all possible because of fintech API solutions.

One company that has transformed this industry is Plaid.

As a leader in account aggregation and financial data access, Plaid connects thousands of financial institutions to fintech apps all around the world.

This platform makes it easier for developers to securely access user-permissioned banking data & supports PayPal and Robinhood as smaller financial tools.

The rise of banking API integration is one of the new standards for building modern financial experiences.

If you want to learn more about banking API integration then you are at the right place.

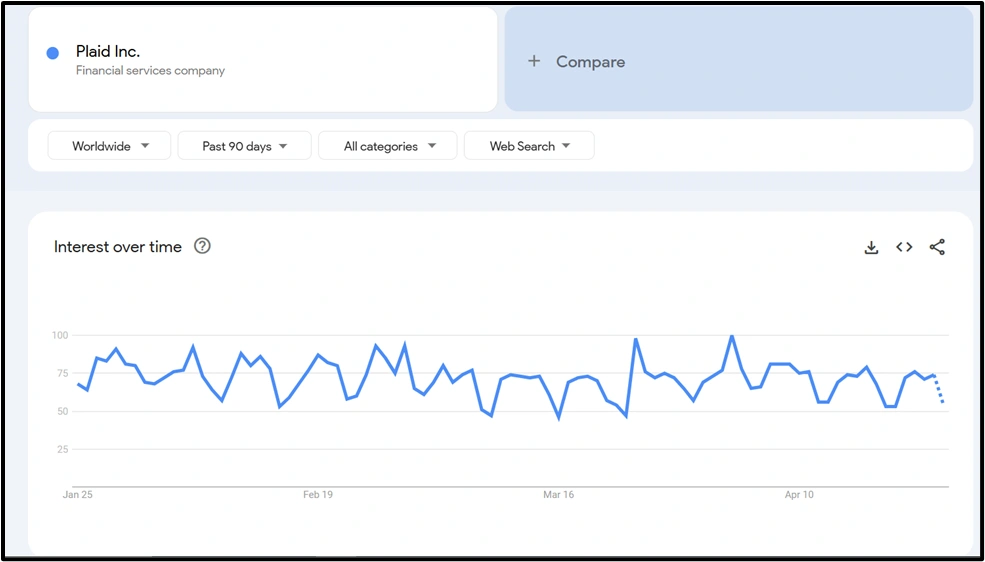

Source: Google Trends

What Are Banking APIs and Why They Matter?

A banking API (Application Programming Interface) is a tool that allows different banking systems and apps to communicate with each other.

It’s like a messenger that safely delivers information between banks and third-party applications whether it’s a budgeting app, a digital wallet, or an online lending platform.

Why Do Banking APIs Exist?

Traditionally, banks operated in divisions. If a fintech app needed access to account data or transaction history, it had to depend upon outdated & manual methods.

But banking APIs changed the game. Now, developers can build smart financial tools that can connect with banks and access real-time data with the user’s permission.

This change to API-driven banking has helped financial services become faster, more secure, and more personalized than ever.

Benefits of Banking APIs

- For developers, banking APIs remove the complexity of connecting with multiple banks. They offer easy-to-use endpoints that handle authentication, data fetching, and security to make development faster and more reliable.

- For financial institutions, APIs create new revenue opportunities through partnerships with fintech apps, improving customer experience, and reducing operational costs.

- For end-users, APIs mean convenience like viewing all your bank accounts in one place, automating savings, or applying for loans with just a few clicks.

Real-World Use Cases

Here’s how banking APIs are helping modern digital banking platforms:

- Budgeting apps like YNAB or PocketGuard use APIs to pull in real-time spending data.

- Investment apps fetch account balances and transaction histories to help users manage portfolios.

- Loan providers evaluate financial health using API-driven access to income and spending patterns.

- Neobanks rely upon APIs to build lightweight & agile banking services without legacy infrastructure.

Learn more about the rise of Neobanks in London.

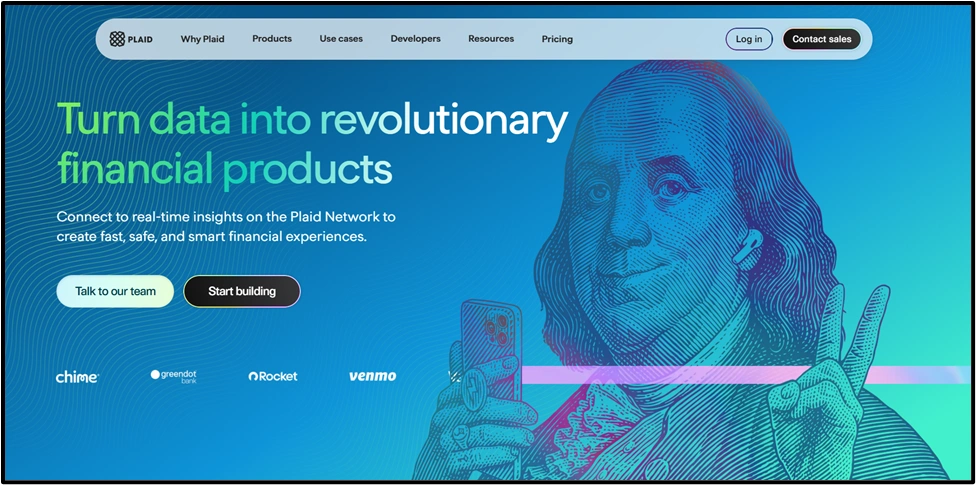

How Plaid Helps Fintech Apps with Secure Banking API Integration?

When it comes to financial data aggregation, one of the most popular names is Plaid.

If you have ever connected your bank account to an app like Venmo, Robinhood, or Coinbase then Plaid was working behind the scenes.

How Plaid Works?

Plaid is one of the most used open banking platforms that helps fintech apps securely connect to thousands of banks and financial institutions.

Its powerful API architecture allows apps to access user-permissioned financial data in a secure & standardized way without dealing with each bank individually.

This makes Plaid API integration best for the developers.

With just a few lines of code, apps can authenticate users, fetch transaction histories, verify income, and even confirm account ownership.

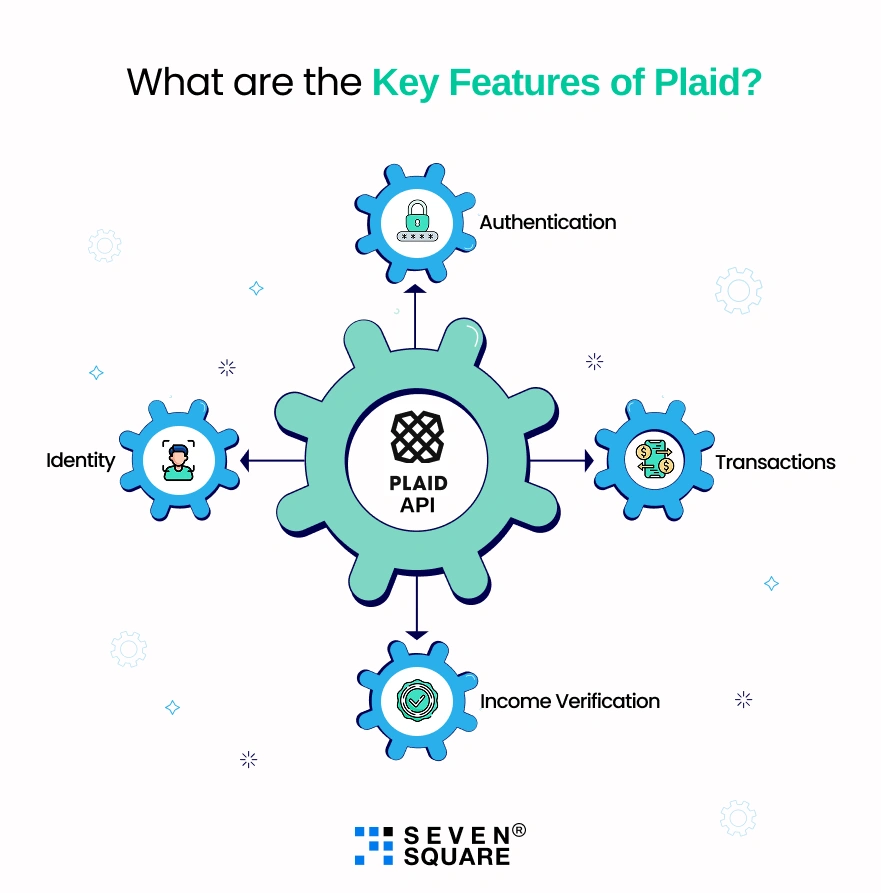

What are the Key Features of Plaid?

Here are some core features that make Plaid important for modern fintech apps:

- Authentication : Plaid handles secure user logins and multi-factor authentication to connect bank accounts safely.

- Transactions : Developers can access categorized transaction data to power spending insights and budgeting tools.

- Income Verification : Apps can verify users’ income streams based on bank activity which is perfect for loans, rentals, or gig workers.

- Identity : Plaid helps apps confirm user identity using verified bank information to reduce fraud risk.

Why Does It Matters?

By simplifying access to banking data, Plaid helps fintech products to launch faster and provide better user experiences.

It eliminates the need for screen scraping & manual uploads by replacing them with real-time & API-based solutions that scale.

Plaid API integration is the engine behind many of the smartest financial data aggregation tools.

It gives developers the building blocks to create the next generation of fintech solutions.

Why has Plaid Got So Much Attention Recently?

Plaid is a leading fintech company specializing in banking API integration and in April 2025, it announced a big funding milestone.

It managed to raise $575 million through a sale of common stock and reach a valuation of $6.1 billion.

Comparatively, this valuation is lower than its previous $13.4 billion in 2021. It shows the market adjustments because of higher interest rates and investor moods.

Franklin Templeton was leading this round from new investors like Fidelity Management and Research, BlackRock, and existing backers NEA and Ribbit Capital.

Plaid does not plan to go public in 2025 but it continues to prepare for a potential IPO in the future.

How Plaid Scaled Open-Banking Rails for Modern Fintech Apps?

Building a secure and scalable fintech platform is not easy but Plaid has done exactly that with the most reliable and developer-friendly open banking infrastructures in the world.

1. Scalable Infrastructure Built for Future Growth

- Plaid’s engineering team designed its systems to handle billions of API calls every month, supporting everything from personal finance apps to fully-functional neobanks.

2. Built-In Security and Compliance

- From end-to-end encryption and OAuth support to multi-factor authentication and consent-based access, Plaid ensures that its secure banking API integration is up to the highest levels of data protection and compliance (like GDPR, CCPA, and beyond).

3. Real-World Examples: Who Uses Plaid?

Plaid isn’t just a backend tool but it is used by some of the most well-known fintech products today:

- Venmo uses Plaid to let users link their bank accounts quickly and securely.

- Robinhood depends upon Plaid for fast account verification and instant deposits.

- Chime is a popular neobank that uses Plaid to onboard users and provide smooth money transfers.

Plaid’s approach to open banking standards is combined with its focus on secure banking API integration to make it a key player in modern fintech solutions.

How We Can Help: API Integration Services for Fintech Startups

Do you want to build a fintech product that connects to users’ financial data? We are here to make it easier, faster, and more secure.

We specialize in fintech API solutions and have helped startups and growing businesses integrate banking APIs.

1. Expertise in Secure Banking API Integration

- We use secure methods for banking API integration to ensure your platform is safe, compliant, and built to scale.

- From authentication and encryption to secure storage and compliance with GDPR/CCPA & we handle it all so you don’t have to worry.

2. Custom Solutions Built Around Your Needs

- Need account aggregation, transaction management, or user data protection features?

- We design custom solutions according to your use case.

- Our team ensures that everything works smoothly from the first API call to your app’s final deployment.

3. From Strategy to Launch

- Strategic API selection

- Secure backend development

- Frontend integration

- Sandbox testing

- Production deployment

- Ongoing compliance support

Want to Build Your Fintech App? Contact Us Today!

What is the Future of Banking APIs? What is Beyond Plaid?

Plaid has become one of the most popular names in fintech but it is also a part of bigger change.

The future of API-driven banking is expanding quickly & bringing in new players, fresh technologies, and even more innovative use cases.

1. New Players in the Open Banking Space

As demand increases, new open banking platforms are coming into the market with unique capabilities. Some of the new players are:

- TrueLayer: It is popular in the UK and Europe for its PSD2-compliant services.

- MX: It focuses on data enrichment and clean user experiences in North America.

- Tink: It is a powerful platform acquired by Visa and used in European markets.

- Salt Edge and Finicity: It provides connectivity with focus on security and compliance.

2. Key Trends for the Future

- Banking as a Service (BaaS) : BaaS is turning traditional banks into platforms. Fintechs can now build apps with ready-made banking features like issuing cards, creating accounts, & offering lending without a banking license.

- Real-Time Payment APIs : Real-time payment APIs are offering instant money transfers, real-time account verification, and smooth checkouts for the next generation of payment systems.

FAQs

- A banking API (Application Programming Interface) is a software interface so that apps can securely access financial data & services from banks.

- It offers functionalities like account verification, transaction history, balance checks, etc.

- Plaid API integration connects fintech apps to users’ bank accounts by securely retrieving account data, transactions, identity, etc.

- It simplifies onboarding, improves financial data insights, and speeds up verification processes.

- Yes, Plaid uses bank-level security protocols, end-to-end encryption, and user consent frameworks to ensure that financial data is protected and securely transferred.

- Banking-as-a-Service (BaaS) allows fintech companies to provide core banking features like issuing cards & opening accounts without becoming a bank themselves.