A few years ago, if you wanted to send money to someone, you had to go to a bank, fill out a lot of paperwork, and wait days for the money to reach them.

Today, things are much easier.

With just a smartphone, you can send money online anytime, anywhere.

Money transfer apps have changed the way we move money by making it faster, cheaper, and more convenient. Now people expect even more.

They want international money transfers to be quick, safe, and as easy as sending a text message.

This is why chat-first remittance apps are becoming so popular.

These new apps let you chat and send money at the same time without using different apps.

In this blog, we tried to show you how you can build a modern remittance app and why chat-first money transfer apps are the future of global payments.

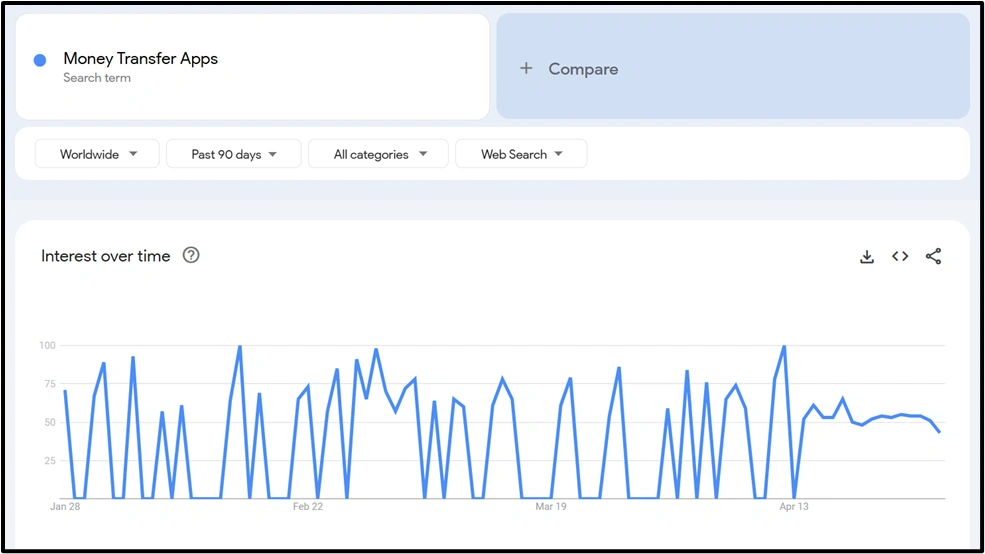

Source: Google Trends

Why Traditional Money Transfer Apps Are No Longer Enough?

Old money transfer apps worked fine but today, they just aren’t good enough.

Many of them are slow, charge high fees, and have confusing steps that frustrate users.

When someone wants to send money online, they expect it to be a quick and easy process.

Older remittance apps used to take days to complete an international money transfer.

Plus, hidden fees and poor exchange rates make people lose a lot of money, and using some of these apps feels more complicated than it should be.

This is why more people are turning to peer-to-peer payment apps and mobile money transfer services.

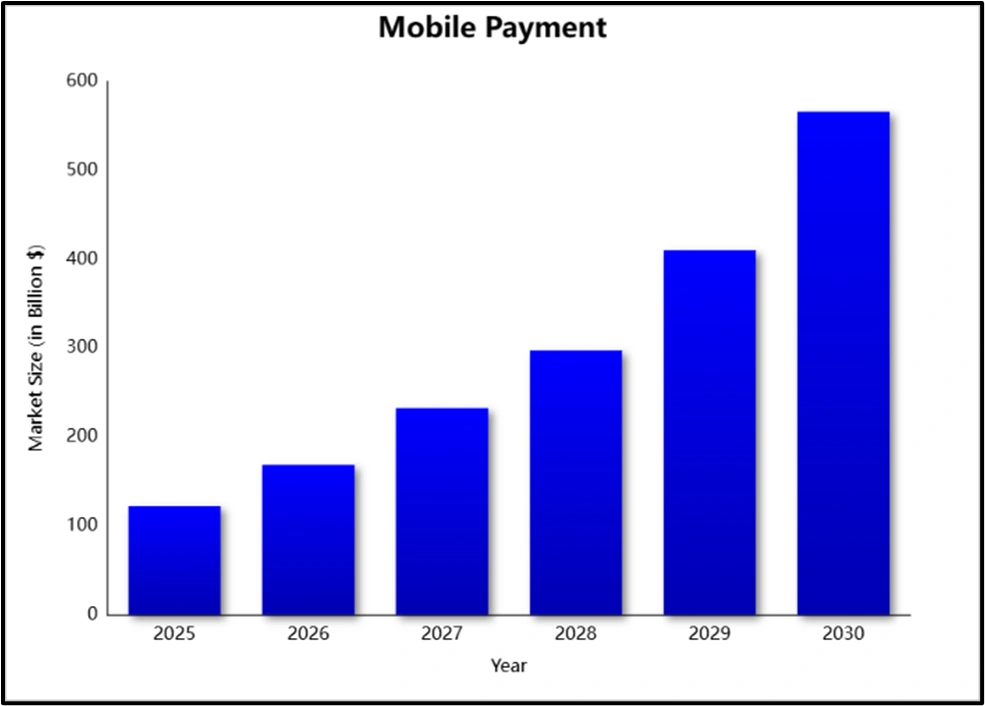

The mobile payment market is expected to reach over $566.07 billion by 2030. Users want speed, simplicity, and control.

Gen Z and Millennials grew up using chat apps like WhatsApp, Instagram, and Snapchat.

They expect the same smooth & real-time feeling when sending money too.

This change in user behavior is creating a huge opportunity for businesses to build chat-first remittance apps that combine messaging and payments into one.

Source: Grand View Research

What is a Chat-First Remittance App?

A chat-first remittance app is a new way to send money online where messaging and money transfers happen together with a smooth experience.

Instead of switching between apps & filling out complicated forms, you can simply chat with someone and send money during the conversation.

Big apps like WeChat, WhatsApp Pay, and Revolut are already showing how powerful this idea can be.

For example, on WhatsApp Pay, you can send money to a friend while you are chatting & no need to open a different app.

This chat-first model is changing the way people think about international money transfers and payments.

- Faster Communication : You don’t have to stop your conversation to make a payment. Sending money happens instantly while you chat.

- Better Transparency : Both sides can see payment confirmations right in the chat to avoid confusion & misunderstandings.

- Instant Transaction Tracking : You can track your money transfer in real-time just like tracking a message delivery.

By combining messaging with payments, money transfer apps are becoming more personal, social, and user-friendly than what today’s users want from a remittance app.

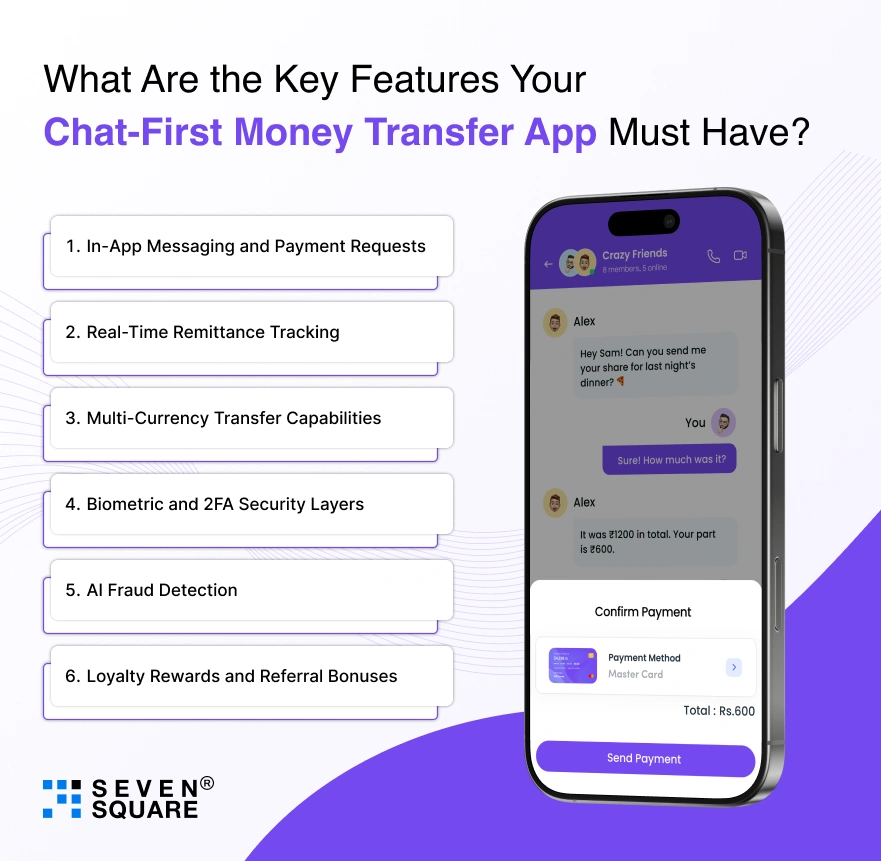

What Are the Key Features Your Chat-First Money Transfer App Must Have?

If you want your money transfer app to stand out and win users’ trust, it needs more than just basic payment options.

To make a real impact, especially for international money transfers, you need smart & user-friendly features that people actually want to use.

Here are the must-have features for a successful chat-first remittance app:

1. In-App Messaging and Payment Requests

- Allow users to chat and send money within the same app.

- They should be able to easily request or send payments during a conversation just like texting a friend.

- This makes the whole experience fast, social, and natural.

2. Real-Time Remittance Tracking

- Once users send money online, they want to know exactly where it is.

- A built-in remittance tracking app feature lets users see updates in real-time to build trust.

3. Multi-Currency Transfer Capabilities

- International users need flexibility.

- Your app should allow multi-currency transfers and handle automatic currency conversions with clear exchange rates with no hidden fees.

4. Biometric and 2FA Security Layers

- Security is a top priority for any secure money transfer app.

- Add fingerprint login, facial recognition, and two-factor authentication (2FA) to keep user accounts and transactions protected at all times.

5. AI Fraud Detection

- Integrate AI tools that can detect suspicious activities quickly.

- This helps block fraud attempts before they happen and makes your app a safer place to send money online.

6. Loyalty Rewards and Referral Bonuses

- Give users reasons to keep coming back.

- Offer cashback, discounts, & rewards for frequent use.

- Referral bonuses can also encourage users to invite their friends which will help your app grow faster.

Adding these features will not only make your remittance app more competitive but will also create a smoother & more enjoyable experience for your users.

What Are The Best Technologies To Build a Chat-First Remittance App?

To build a powerful chat-first money transfer app, you need the right technology behind it.

A good tech stack makes it easier, faster, and safer for people to send money online, especially for international money transfers.

Here are the best technologies you should use:

1. API-First Architecture for Payment Gateways

- An API-first architecture helps your app connect smoothly with international payment gateways.

- It allows faster integration with banks, mobile wallets, and currency exchange services to make global money transfers quick and reliable.

2. Blockchain for Instant, Low-Fee Transactions

- Blockchain technology can make international money transfers faster and cheaper.

- It removes middlemen, lowers fees, and ensures that transactions are secure and transparent.

- Best for users who want instant and trusted transfers across borders.

3. AI Bots for Instant Customer Support

- Waiting for customer service can be frustrating.

- AI-powered chatbots can answer user questions instantly, help with payment issues, and guide users through sending money all inside the app.

- This improves customer satisfaction and keeps the support system running 24/7.

4. End-to-End Encryption for Chats and Transactions

- When people send money online, they want their information to stay private.

- End-to-end encryption protects both chats and transactions, making your app a fully secure money transfer app. It’s a must-have for building user trust.

5. Push Notifications and Smart Alerts

- Keep users updated with push notifications.

- Send smart alerts when money is received when transactions are completed, and if there’s an issue.

- It helps users stay informed and builds a stronger connection with your app.

Using these technologies will help you create a remittance app that is fast, smart, and highly secure. Every feature that a money transfer app should have.

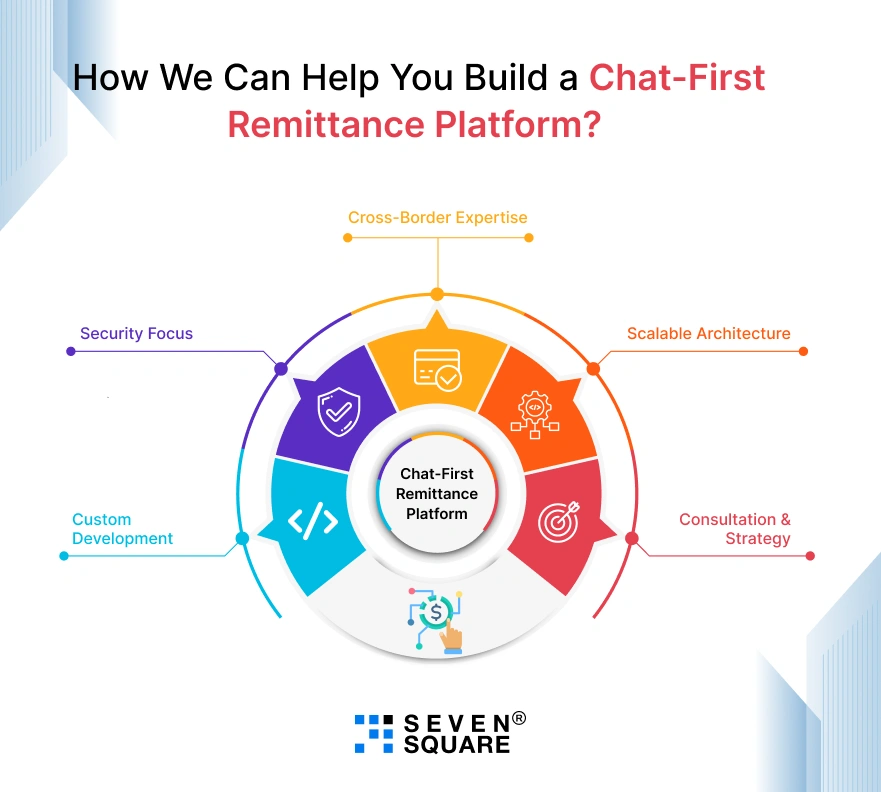

How We Can Help You Build a Chat-First Remittance Platform?

We specialize in creating modern remittance apps designed for today’s mobile-first world.

Learn more about top AI chatbots for eCommerce.

Here’s how we can help:

1. Custom Development

- We build fully customized money transfer apps with a chat-first user experience.

- From the design to the payment engine, everything is built according to your brand and your audience perfectly.

2. Security Focus

- We implement top-grade end-to-end encryption, fraud detection, and ensure full compliance with global financial regulations.

- Your users can send money online with complete peace of mind.

3. Cross-Border Expertise

- We integrate the best payment gateways, currency exchange systems, and cross-border services to make sending money across the world simple.

4. Scalable Architecture

- Whether you’re starting with a small MVP or aiming for millions of users, we design scalable systems that grow with you.

- Your remittance app will stay fast and dependable no matter how big your business gets.

5. Consultation & Strategy

- Our team offers expert consulting for your product strategy, user flow, and launch plan, so you can dominate your niche and attract loyal users.

Want to launch the next big money transfer app? Contact Us Now!

The Future of Money Transfer Apps: What’s Next?

As more people choose chat-based experiences, new trends are changing the future of money transfer apps and remittance apps. Here’s what’s coming next:

1. Rise of Decentralized Finance (DeFi)

- Decentralized finance (DeFi) is removing banks from the equation.

- Soon, more international money transfers will happen directly between users through blockchain with lower fees and faster speeds.

2. Hyper-Personalization: Predictive Transfers and Deals

- Remittance apps will soon predict your needs.

- If you regularly send money to family abroad, your app might suggest transfers at the best exchange rates & even offer personalized rewards.

3. Integration with Super Apps

FAQs

- A money transfer app is a mobile or web application that allows you to send money online locally & internationally, quickly and securely.

- A chat-first money transfer app provides faster communication, instant transaction tracking, better user experience, and easier international money transfer all in one place.

- Yes, Modern money transfer apps use end-to-end encryption, biometric security, two-factor authentication (2FA), and AI fraud detection to keep your data and money safe.

- Yes, many chat-first money transfer apps support international money transfers so that users can send money across borders in different currencies with low fees and real-time tracking.

- Yes, most remittance apps have daily, weekly, & monthly limits for security and compliance reasons.

- These limits can often be increased by verifying your identity & upgrading your account.